This guide explains how to document gift funds for a mortgage and meet lender requirements. Follow these steps to ensure a smooth home-buying process.

What are gift funds when buying a home?

Gift funds are financial contributions from family members, close friends, or organizations. These funds help cover down payments or closing costs for purchasing a home.

Gift funds are a helpful way to reduce upfront costs, but lenders require specific documentation to confirm the funds qualify.

Who can provide gift funds?

Acceptable donors include:

Relatives:

Spouses, children, parents, or anyone related by blood, marriage, adoption, or legal guardianship

Close Friends:

An unmarried partner, mortgage co-signer, former relative, a relative of a domestic partner, or a godparent

Charitable or government organizations:

Nonprofits, employers, or labor unions offering assistance programs

Suppose you intend to purchase a condominium worth $500,000 by providing a down payment of $15,000, equivalent to 3% of the total cost, and obtaining a mortgage loan of $485,000 from a lender. Your parents have kindly offered to assist you by providing the down payment funds.

- $500,000 purchase price

- $485,000 loan amount

- $15,000 gift for the down payment

Unacceptable gift situations

Gift funds are not allowed if:

The gift is a loan:

There can be no repayment agreement, written or implied.

The donor has a financial interest in the property:

Sellers, agents, or others involved in the sale cannot provide gift funds. However, sellers can pay sellers can pay closing costs.

The gift is for an investment property:

Most lenders prohibit gift funds for non-primary residences.

The source is unverified:

Cash gifts or untraceable funds are usually unacceptable.

Joanne's bank statement shows a significant deposit. The lender asked her to provide documents verifying where the money came from. Because her brother gave her cash, she couldn't provide any paperwork.

The lender couldn't ensure that the cash gift was from an acceptable source, not from someone with a financial interest in the property, such as the seller or the real estate agent. Therefore, the lender subtracted the large deposit from the funds available for closing.

How to document gift funds

Lenders require the following:

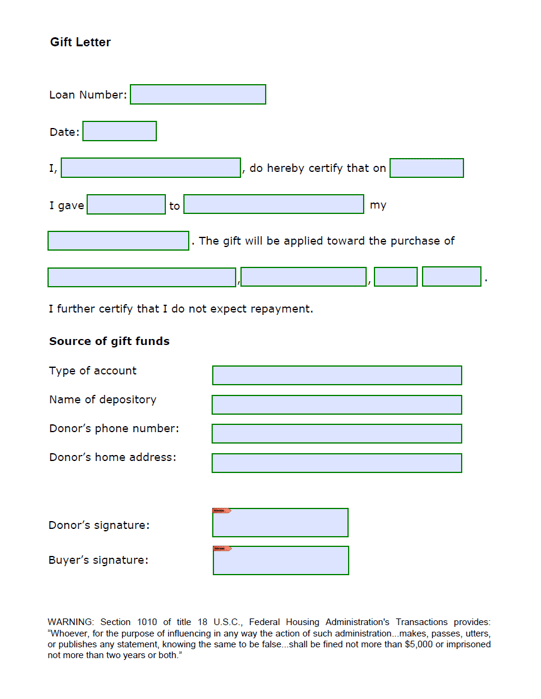

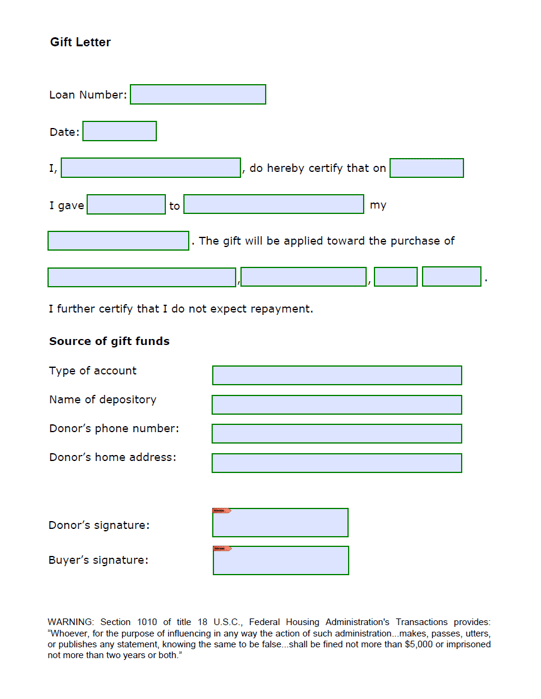

Gift letter:

A signed document from the donor including:

- Donor’s name, relationship, and contact information.

- Gift amount.

- A statement confirming the funds are a gift, not a loan.

Download the following gift letter template. Then, complete, e-sign, and send it to the lender.

Proof of transfer:

Clear evidence of the transaction, such as:

- Donor’s bank statement showing the withdrawal.

- Wire transfer or cashier’s check.

- The recipient’s bank statement shows the deposit.

Joanne is buying a home, and her parents gift her $15,000 for the down payment. To meet lender requirements, Joanne provided:

- A signed gift letter from her parents.

- A complete bank statement from her parents showing the withdrawal.

- Proof of transfer via electronic confirmation.

- Her bank statement reflects the deposit.

Joanne gave the lender a copy of her most recent bank statement. She included the transaction activity from her online banking account since she deposited the gift funds after the close date of the last statement. The account activity shows all transactions, including the gift funds deposit, from the last statement to the present.

When reviewing financial information, mortgage lenders require complete bank statements, including all pages. Many mortgage lenders will accept an account transaction history as an alternative as long as it:

- Includes all deposits, withdrawals, and account balances

- Identifies the account holder and the financial institution

- Shows the last four digits of the account number

- Covers at least 30 days

Step-by-step guide to using gift funds

Get Pre-Approved:

Before house hunting, get pre-approved for a mortgage to determine your budget.

Verify Eligibility:

Confirm with your lender that the gift qualifies and request a list of required documents.

Provide Documentation:

Submit the gift letter, bank statements, and transfer confirmation during the mortgage approval process.

Consider Direct Transfer at Closing:

The donor can wire funds directly to the settlement agent. This minimizes paperwork and ensures a clear transaction.

Questions about gift funds? Schedule a few minutes to talk to a mortgage expert. Ask questions, get straight answers, and find out how to start on your home loan.

Can the donor borrow gift funds?

Donors can borrow gift funds, but they must prove they obtained the money from an acceptable source and are responsible for repaying the loan.

Your parents want to give you $15,000 to help you buy a house. Unfortunately, the money isn't readily available, so they take out a $15,000 loan from a bank and give it to you.

In this case, provide the lender with a copy of the loan statement or agreement. The lender will accept the gift as long as your parents are responsible for repayment.

Buying a home starts with a mortgage pre-approval. You can get yours today to take advantage of every opportunity to buy the perfect home.

Can gift funds pay off debts?

You can use gift funds to pay off debts to qualify for a mortgage if funds come from an acceptable donor. Paying off debt can help reduce your debt-to-income ratio and qualify for a mortgage.

Let's say your parents want to give you some money to help you buy a home. However, you don't qualify for the mortgage because your debt-to-income ratio is too high.

You can use your parent's gift to pay off credit card debts, lower your debt-to-income ratio, and qualify for the mortgage.

Can I use wedding or graduation gift funds?

You can use wedding, graduation, and similar gifts towards the down payment on a house if deposited within 90 days of the event and supported by:

First, deposit the gift funds to your bank account within 90 days of the marriage license or graduation date. Then, provide the lender with the following documents:

- A marriage license or graduation certificate.

- A letter explaining the source of funds.

Newlyweds received gifts from friends totaling $8,000, which they deposited into their bank account. They want to use the money towards the down payment on a home. The lender asked the buyers to document the source of the deposits.

The couple gave the lender the following documents to document the source of the gift funds:

- A copy of their marriage license

- A bank statement showing they deposited the gifts to their bank within 90 days of the wedding

- A signed letter listing the wedding gifts (You don't need gift letters from your friends.)

See the actual rate and monthly payment upfront on our website. Then, feel confident about buying a home because you know what to expect.

Are gift funds from abroad allowed?

Mortgage lenders accept gifts from different countries with certain conditions.

- Transfer the funds to a U.S. bank account.

- Provide documentation translated into English.

- Convert foreign currencies to U.S. dollars.

Clear and transparent documentation of the gift transaction is crucial to demonstrate to the lender that the funds are legitimate gifts, not loans.

Key gift fund rules by loan type

Gift fund requirements vary by loan type and the lender's requirements. Check with your lender for more information.

You can feel confident about making an offer to buy a home. Getting a verified mortgage pre-approval letter signed by one of our underwriters enhances your negotiating power, especially when competing with other buyers.

Feel free to ask a question or leave a comment below.