How to Get a DACA Mortgage Loan

Contents

How much do DACA recipients need for a down payment on a house?

DACA recipients can buy a home with as little as 3% down on a single-family home, condo, or townhouse they plan to live in.

Your exact down payment depends on several factors, including the property type, whether it will be your primary residence, your credit and income, and the lender’s requirements.

At NewCastle Home Loans, we make it simple. DACA recipients get the same low down payment options as U.S. citizens, just 3% down for qualifying buyers purchasing a primary residence. That keeps upfront costs low, so you can focus on finding the right home.

If you buy a house for $350,000, your minimum down payment is 3%, which is $ 10,500.

- Purchase Price: $350,000

- Loan Amount: $339,500

- Down Payment: $10,500

Suppose you're buying a 2-to-4-unit property, planning to use the home as an investment, or have unique financial circumstances. In that case, the required down payment may be higher.

The following chart shows the amount of money you'll need for the down payment when purchasing a home as your primary residence.

Primary residence—Minimum down payment |

||

|

Loan type

|

Property type

|

Down payment

|

|

Conventional

|

1-unit

|

3%

|

| 2-to-4-units |

5%

|

|

The minimum down payment for a second home is 10% of the purchase price.

Second Home—Minimum down payment |

||

|

Loan type

|

Property type

|

Down payment

|

|

Conventional

|

1-unit

|

10%

|

When buying an investment property, the minimum down payment is 15% of the purchase price.

Investment Property—Minimum down payment |

||

|

Loan type

|

Property type

|

Down payment

|

|

Conventional

|

1-unit

|

15%

|

|

2-to-4-units

|

25%

|

|

Talk to a loan expert at NewCastle to understand your down payment options.

How much will a DACA mortgage cost?

A DACA mortgage costs the same as a mortgage for U.S. citizens. There are no additional fees or higher rates due to your DACA status.

The exact cost depends on factors like your down payment, loan amount, interest rate, repayment term, and lender fees. You’ll pay two types of costs:

-

Upfront costs at closing, including your down payment and closing costs.

-

Ongoing costs after closing, which are your monthly mortgage payments.

To see how this applies to your situation, try our free mortgage calculator. You can:

- Enter the purchase price, down payment, and credit score.

- Instantly view the rate, monthly payment, and closing costs.

- Get clear numbers so you know exactly what to expect when buying a home.

Change the purchase price, down payment, and loan type. Then calculate the costs using current rates. Feel free to explore the options to choose the right loan for your home.

Do I qualify for a DACA mortgage?

The loan approval requirements are the same for DACA recipients as for U.S. citizens.

You’ll need to meet the minimum credit score requirement, prove a history of employment, provide a record of your income, and show that you have enough money to cover the down payment and closing costs.

- Credit score: 620 minimum

- Proof of income. Lenders typically require recent pay stubs and W-2 statements for the last two years. If you're self-employed, provide the lender copies of your federal tax returns for the last two years.

- Employment history. Your employment and income should be steady and likely to continue.

- Proof of sufficient funds to close. Provide copies of your most recent bank statements.

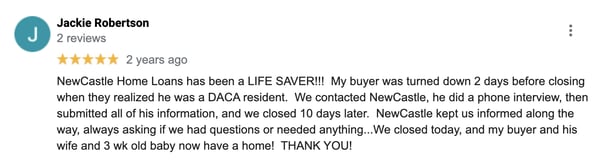

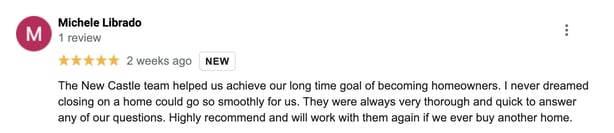

Our team of home loan experts is dedicated to helping you get your mortgage. Here are just a few instances when we’ve been able to secure home loans for Dreamers with more complex qualifying conditions:

Marco's income recently increased.

Marco has worked in retail management for three years and recently received a raise. His hourly wage increased from $16 to $21. While other traditional mortgage lenders may use Marco’s average income over the last two years, we used Marco’s new, higher wage to measure his income because he has a proven employment history at his current job.

Isobel just started a new career.

Isobel graduated recently and started working two months ago. In her new teaching job, she makes $51,000 annually. While Isobel hasn’t been at her current job for the standard two years, she has an additional three years of experience in education, having studied at the university level. We used her current income on her mortgage application, given her combined years of study and work experience in education.

Alex changed jobs recently.

Alex works in sales but recently changed jobs. He received commission income in his previous and current roles, totaling $10,000 in prior years and $20,000 in the last year. We averaged his commission earnings across his current and prior roles over the past 24 months and used $15,000 to approve his home loan.

Buying a home starts with a mortgage pre-approval. Getting pre-approved through a lender familiar with your situation will help you better understand your down payment options.

Work with a lender who understands DACA mortgages.

Not all lenders work with DACA recipients, but we do. At NewCastle Home Loans, we know the process, the paperwork, and the challenges you might face. That means no surprises, no last-minute denials, and no wasted time.

We make it easy to get pre-approved in 1 day and close in as little as 2 weeks—all with a great rate.

You can rely on our team of certified mortgage underwriters to guide you through the path to homeownership and ensure a smooth process.

How can I get pre-approved for a mortgage if I have DACA status?

Getting pre-approved for a mortgage as a DACA recipient follows the same process as for any other homebuyer. However, due to your immigration status, you may have additional documentation requirements.

Follow our 3-step closing plan to get quickly approved or pre-approved.

1. Apply online.

- Complete the application and select your loan

- Check your credit

- Share your income documents, such as pay stubs, W-2 statements, and tax returns.

2. Get your pre-approval letter.

- Our mortgage underwriters verify your information.

- We approve your application.

- You get a verified mortgage pre-approval letter signed by an underwriter.

3. Close in 2 weeks.

- Share your pre-approval letter with your real estate agent.

- Find the home you want, and make an offer to buy it.

- Once the seller accepts your offer, we will complete the mortgage process and prepare for your closing.

Can a DACA recipient refinance their home with an FHA loan?

DACA recipients are not eligible to refinance with an FHA loan. However, you can refinance with a conventional mortgage, and it might work in your favor.

If you bought your home with an FHA loan, you can replace it with a conventional loan when you refinance.

One of the biggest advantages? You could lower or even eliminate your mortgage insurance.

Conventional loans don’t require mortgage insurance if you’ve built up 20% or more equity in your home. That means lower monthly payments and more savings over time.

At NewCastle Home Loans, we’ll help you explore your options and make the switch simple.

Start your refinance application online.

.png?width=616&name=Karina_Arreloa%20-%20Google%20review%20(DACA).png)