What does PITI mean? PITI mortgage calculator

Contents

After you apply for a loan, the lender will send you a Loan Estimate. You will see the PITI in the Projected Payments section on page one.

Is the PITI the same as the monthly amount I pay the mortgage lender?

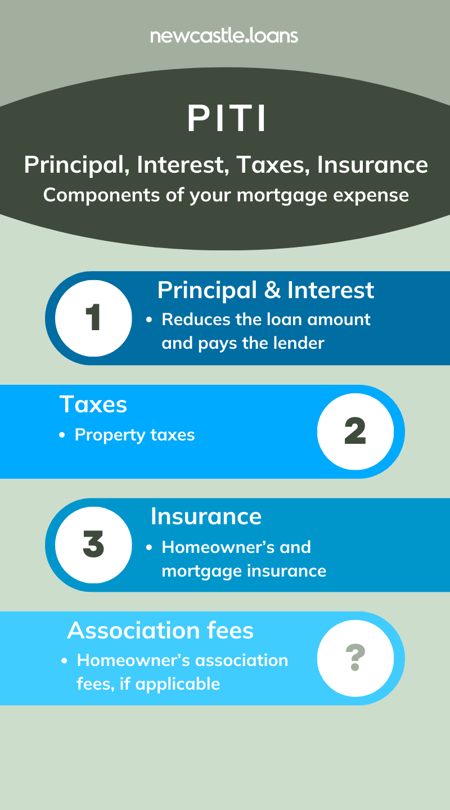

The PITI (Principal, Interest, Taxes, and Insurance) is not always the same as the monthly amount paid to the mortgage lender.

The PITI is a breakdown of the components of a mortgage payment the lender uses to determine if you qualify for the loan. In contrast, your mortgage payment is the monthly amount you send to the lender.

Your mortgage payment always includes the principal and interest portions of the loan, which go directly toward repaying the borrowed amount and compensating the lender for providing the funds. However, your mortgage payment may or may not include property taxes and homeowner's insurance, depending on your loan agreement,

Most first-time homebuyers have a lender-managed escrow account. When you escrow with the lender, your monthly payments include property taxes and homeowner's insurance. The lender holds the funds in the escrow account and pays the bills when they are due.

Some homebuyers waive the lender escrow and pay property taxes and homeowner's insurance separately to the relevant entities.

For example, I waived the lender escrow on my mortgage. Each month, I pay the lender principal and interest. Then, I pay the county property tax bills and homeowner's insurance premiums when they are due.

While the PITI represents the overall structure of the mortgage payment, the specific amount you pay to the lender might consist of the principal and interest, with taxes and insurance being paid separately by you or included in the lender-managed escrow account. The breakdown can vary based on the loan terms and agreement.

How do you calculate PITI?

To calculate your PITI (Principal, Interest, Taxes, and Insurance), follow these four steps:

Let's say you plan to buy a $350,000 Chicago condo with a 5% down payment using a 30-year fixed-rate mortgage at 7%.

- Purchase price: $350,000

- Down payment: $17,500 or 5% of the purchase price

- Loan amount: $332,500 or 95% of the purchase price

- Interest rate: 7%

1. Calculate the principal and interest.

Use a mortgage payment calculator to get the monthly principal and interest payments.

| Loan amount | $332,500 |

| Interest rate | 7.000% |

| Loan term | 30 years (360 months) |

| Principal and interest | $2,212 |

2. Estimate the monthly property tax.

Yearly property taxes are typically 1%-to-2% of the sales price, depending on the property type and location. For a house in Chicago, estimate the tax bill by multiplying the sales price by 2%. Then, divide by 12 to get the monthly property tax payment.

| Sales price | $350,000 |

| Annual property tax | $7,000 |

| Monthly tax | $583 |

| $350,000 Sales price x 2% Annual property tax rate = $7,000 Annual tax ÷ 12 = $583 | |

3. Estimate the monthly insurance.

Homeowner's insurance (HOI) is usually between 0.15%-0.5% of the loan amount, determined by the property type and condition. Estimate the premium for a Chicago condo by multiplying the loan amount by 0.15%.

| Loan amount | $332,500 |

| Annual HOI | $499 |

| Monthly HOI | $42 |

| $332,500 Loan amount x 0.15% HOI rate = $499 Annual HOI ÷ 12 = $42 | |

Private mortgage insurance (PMI) is required when your down payment is less than 20% of the purchase price. The amount varies based on several factors. For now, estimate the annual cost at 0.5% of the loan amount.

| Loan amount | $332,500 |

| Annual PMI | $1,663 |

| Monthly PMI | $138 |

| $332,500 Loan amount x 0.50% PMI rate = $1,663 Annual PMI ÷ 12 = $138 Monthly PMI | |

4. Add the principal, interest, taxes, and insurance.

Don't forget to include the homeowner's association

| Principal and interest | $2,212 |

| Property taxes | $583 |

| Homeowners insurance (HOI) | $42 |

| Mortgage insurance (PMI) | $138 |

| Homeowner's association fees (HOA) | $0 |

| PITI | $2,975 |

Use our interactive mortgage calculator to view current rates and payments, including estimates for property taxes, homeowner's insurance, and PMI.

Mortgage payment calculator

A mortgage payment calculator is a simple tool that helps you determine your total housing cost. Enter the purchase price, down payment, and interest rate. It computes the monthly principal and interest payments.