How to buy a condo with an FHA loan

Contents

Buying a condo with an FHA loan can be tricky.

The condo must be FHA-approved. But unfortunately, there are few. The chances of finding one in the neighborhood where you want to buy are low.

In Chicago, FHA has approved 140 condo buildings, less than two percent of the estimated 12,235 in the City.

You're in the right place if you want to use an FHA loan to buy a condominium. NewCastle Home Loans can help you whether the condo building is on or off the FHA's approved list. We can get a specific unit within a condo building approved so that you can move forward with your home-buying plans.

The program is Single-Unit Approval, and I'll explain how it works in this article.

Why use an FHA loan to buy a condo

People typically buy condos because they're more affordable than houses, especially in urban areas like Chicago. Many can't afford single-family homes, along with property taxes and upkeep. They need the affordability, location, convenience, and security condos offer.

Condo sales are about two-thirds of all Chicago home sales, according to Crains.

FHA loans are often the only way for buyers, particularly first-timers, to finance homes. FHA loans are typically easier to get approved for than conventional loans.

For example, you can have a lower credit score and more debt and buy a home with a down payment of only 3.5% of the purchase price. The table below compares FHA and conventional mortgages' credit scores, debt, and down payment requirements.

| FHA Loan | Conventional Loan | |

| Credit score minimum | 580 | 620 |

| Debt to income maximum | 55% | 50% |

| Down payment minimum | 3.5% | 3% |

| Loan limit 2026 | $524.225 | $832,750 |

Overall, an FHA loan can be a good option for buying a condo if you have a lower credit score, a smaller down payment, or want to take advantage of FHA loans' more lenient qualifying criteria. However, FHA loans have certain limitations and requirements, such as the condominium approval process.FHA loans made up 13.64% of all the mortgages in the U.S. in 2024, according to the HUD.

What is an FHA-approved condominium?

Before you can buy a condo using an FHA loan, the FHA must approve it. This process is known as FHA condo approval, and the FHA offers two types.

- FHA project approval is when the condo homeowner's association (HOA) applies to FHA. FHA reviews the application and approves the condo project or building. All units in the building are eligible for FHA financing.

- FHA single-unit approval is a process by which an FHA mortgage lender evaluates the condo to determine whether it meets the minimum standards for an FHA loan. If a property meets these standards, the lender requests a one-time FHA approval. If granted, the lender may use one FHA loan to finance one unit in the building.

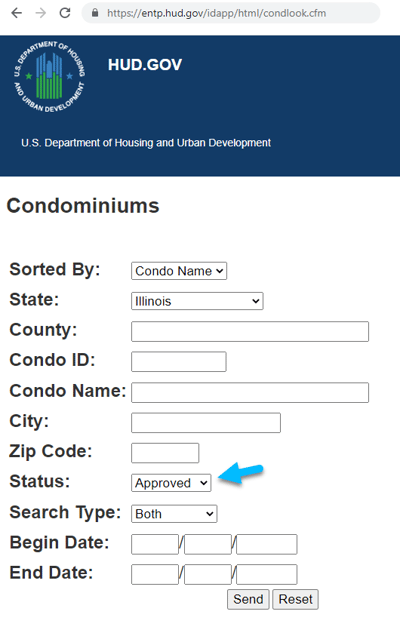

How do I find an FHA-approved condo?

To find an FHA-approved condo, visit the FHA condominium page on its website. You can search for approved condos by state, county, or zip code.

If the condo is on the list, you can use an FHA loan to buy a unit without additional steps. If the condo is not listed, you can request single-unit approval through an FHA-approved lender that handles these requests.

The condo you want to buy is probably not on the FHA's list. You need single-unit approval from an FHA-approved lender, such as NewCastle Home Loans. Contact us today so that we can review and approve the condo for an FHA loan.

What is an FHA single-unit approval?

Only an FHA-approved mortgage lender that accepts applications for single-unit approval will evaluate your condo unit to determine whether it meets the minimum standards for an FHA loan.

A condominium must meet specific requirements to qualify for an FHA single-unit approval, such as:

- The building must have five or more units.

- A maximum of 35% may be commercial space.

- At least 50% of the units must be owner-occupied.

If the building meets FHA requirements, the lender requests a one-time approval from FHA. The lender may issue a final mortgage commitment to the homebuyer and close if approved.

Remember that a single-unit approval is a one-time approval for a specific unit within the condo building. It doesn't approve the entire project.

How to get FHA single-unit approval?

Follow these steps to get a single-unit approval.

1. Get pre-approved for a mortgage through an FHA-approved lender.

Choose an FHA-approved lender, such as NewCastle Home Loans, that accepts applications for single-unit condo approvals. Ask the lender's representative before starting the process with them.

Next, get pre-approved. Start by answering questions about yourself and the home you want to buy on our website or by phone with one of our loan officers.

Mortgage pre-approval means our loan underwriter verifies your financial information, including your credit, income, debt, and available cash to buy a home. We check your credit and verify your financial information to ensure your FHA mortgage will be ready for closing after we approve the condo.

FHA loans offered by NewCastle Home Loans have minimum requirements, such as:

- Your credit score must be 580 or higher.

- Your down payment must be at least 3.5% of the purchase price.

- Your loan amount can be, at most, $524,225.

FHA loans have a cap of $524,225. If you make a minimum down payment of 3.5%, the maximum purchase price is $543,238. Buying a property for more than this requires a down payment greater than 3.5%.

- $543,238 Purchase price

- $19,013 Down payment of 3.5%

- $524,225 Base loan amount of 96.5%

Then, after our mortgage underwriter verifies your information, you will receive a personalized mortgage pre-approval letter on the same day.

The pre-approval letter is essential because it shows how much you can borrow, how much you can afford to pay monthly for the mortgage, and how much money you'll need at closing when you buy your home. It also shows the sellers and agents that you're a serious buyer and can get the loan you need to buy a house.

2. Make an offer that the seller accepts.

Hire a real estate agent and give her a copy of your mortgage pre-approval letter. Your agent helps you find the perfect home and make an offer to buy it. Also, your agent knows the neighborhood and how to negotiate and process paperwork. Best of all, your buyer's agent is free - the seller pays her commissions.

As your agent narrows your search and finds homes for you to see, use our calculator to estimate rates, payments, and costs. Run multiple scenarios. And feel free to contact one of our mortgage experts with questions.

After finding a place to buy, your real estate agent prepares your offer. Include a copy of your pre-approval letter with your offer to show the sellers you're ready to close quickly.

Your agent will tell the sellers that you're financing the purchase with an FHA loan. However, because the sellers want to avoid issues that may cause delays, they may view FHA financing as a potential issue and reject your offer.

Still, be upfront with sellers. Your real estate agent and mortgage lender can discuss your FHA loan with the seller's agent. Ultimately, the sellers decide to accept, decline, or negotiate. Expect some back and forth - and hopefully, the sellers will take your contract.

3. The lender requests single-unit approval.

After you and the sellers are under contract, NewCastle Home Loans begins working on the single-unit approval by requesting the information from the condominium management company. The management company completes a questionnaire and provides the HOA's legal and financial documents.

Typically, single-unit approval takes about one week after we receive the required documents from the management company. But it could take longer, depending on when they send us the documents.

After we receive the documents, we evaluate them to determine whether the condo is acceptable. If it meets the FHA's requirements, we process a request for single-unit approval through the FHA and await their reply. Then, if the FHA accepts, we issue a final mortgage commitment and prepare to close on your new home.

Can I refinance a condo using an FHA loan if the property isn't FHA-approved?

FHA's Streamline Refinance mortgage doesn't require condominium approval. It's the only FHA loan that allows you to refinance from an FHA loan to another FHA loan in an unapproved condo.

You can use the streamline refinance to lower your interest rate and payment, but you can't take any cash out of the property. Before using an FHA cash-out refinance, you'll need to apply for single-unit approval, go through the process, and get the condo approved before closing.

Consider a conventional loan if you're interested in refinancing your condo but can't qualify for an FHA loan.

© 2026 NewCastle Home Loans, LLC. All rights reserved.

Lending in Florida, Illinois, Indiana, and Tennessee.