The cost of private mortgage insurance (PMI) varies depending on several factors, including the lender. Some lenders charge more than others for the same PMI. In this article, I'll explain why. Then, I'll show you how to get the lowest PMI on your home loan.

What is Private Mortgage Insurance (PMI)?

PMI is a monthly fee rolled into your mortgage payment required when you use a conventional loan to buy a home, and your down payment is less than 20% of the purchase price.

The fee pays for insurance that protects the lender if you default on your mortgage. The insurance lowers the lender's risk of making a loan to you, so you can qualify for a mortgage you might not otherwise get.

While PMI is an added cost, it enables you to buy now and begin building equity versus waiting years to save up for a 20% down payment.

How much is mortgage insurance?

PMI is a small percentage of the loan amount called the PMI rate. The lender calculates the PMI payment by multiplying your loan amount by the PMI rate and dividing by 12.

Suppose the loan amount is $475,000, and the PMI rate is 0.45%. In that case, the lender calculates your monthly PMI payment as follows.

- $475,000 × 0.45% = $2,137.50 ÷ 12 = $178.13

Then, the lender adds $178.13 to your monthly mortgage payment.

Remember, this is an example and not the actual PMI. The lender decides the exact PMI rate based on your down payment, credit score, debt-to-income ratio, and other factors.

Check out our Loan Estimate Explainer for more information about closing costs, including mortgage insurance. Talk to a home loan expert to ask questions, get straight answers, and find out how to start on your home loan.

Does the down payment amount affect the PMI payment?

Your down payment percentage affects your PMI rate and monthly payment.

A large down payment means you have more equity in the home, which reduces the lender's risk. As a result, you get a lower PMI payment. On the other hand, a small down payment increases the lender's risk, resulting in a higher PMI payment. (Loan-to-value.)

For example, PMI is cheaper when your down payment is 10% compared to 5%. And you avoid PMI altogether by putting down 20% or more.

The following table compares estimated PMI rates and payments for 3%, 5%, 10%, and 15% down payments on a $500,000 house.

| Down payment percent |

Down payment |

Loan amount |

PMI rate |

PMI monthly payment |

| 3% |

$15,000 |

$485,000 |

0.60% |

$242.50 |

| 5% |

$25,000 |

$475,000 |

0.45% |

$178.13 |

|

10%

|

$50,000 |

$450,000 |

0.30% |

$112.50 |

| 15% |

$75,000 |

$425,000 |

0.15% |

$53.13 |

| 20% |

$100,000 |

$400,000 |

0.00% |

$0.00 |

Let's say you're buying a house for $500,000.

- If you make a 10% down payment, multiply the loan amount of $450,000 by 0.3% and divide by 12 to get your monthly PMI payments of $112.50.

- If you make a 5% down payment, multiply the loan amount of $475,000 by 0.45% and divide by 12 to get your monthly PMI payments of $178.13 —$65.63 more per month. Your loan amount and principal & interest payments would increase, too.

Again, this is just an example. Your actual PMI payments depend on your unique situation and the lender you choose to handle your home loan.

To view actual PMI payments, use our PMI calculator. It's easy to get current mortgage rates and monthly payments, including PMI, so you know what to expect when buying a home.

Can credit score and debt-to-income ratio affect PMI?

Your credit score and debt-to-income ratio can impact the rate and payment for PMI when buying a home.

Credit score: Your credit score is a measure of your creditworthiness used to determine the risk of lending money to you. The higher your credit score, the lower the risk you pose to the lender, which can result in a lower PMI rate. On the other hand, a lower credit score may indicate a higher risk, resulting in a higher PMI rate.

Debt-to-income ratio (DTI): Your debt-to-income ratio measures how much of your monthly income goes towards paying off debt. A high DTI can indicate that you may have trouble making your mortgage payments, resulting in a higher PMI rate. A low DTI, on the other hand, means you have more disposable income for your mortgage, which can result in a lower PMI rate.

Do some lenders charge more for the same PMI?

The lender can significantly impact the cost of PMI. PMI varies by lender, with some charging more than others for the same mortgage insurance. Here's why.

The lender chooses the PMI company from their list of approved providers. There are seven PMI companies in the U.S., each offering different rates. Still, most lenders use only some of the PMI companies. And they're likely to miss the lowest when they don't compare PMI rates with all seven. As a result, you get stuck with higher monthly payments.

PMI may cost less through a different lender.

Although you can't shop for the cheapest PMI directly through the PMI companies, you choose the lender offering the PMI. Before deciding which lender to use for your home loan, compare how much they charge for PMI. This way, you know you're paying the right amount.

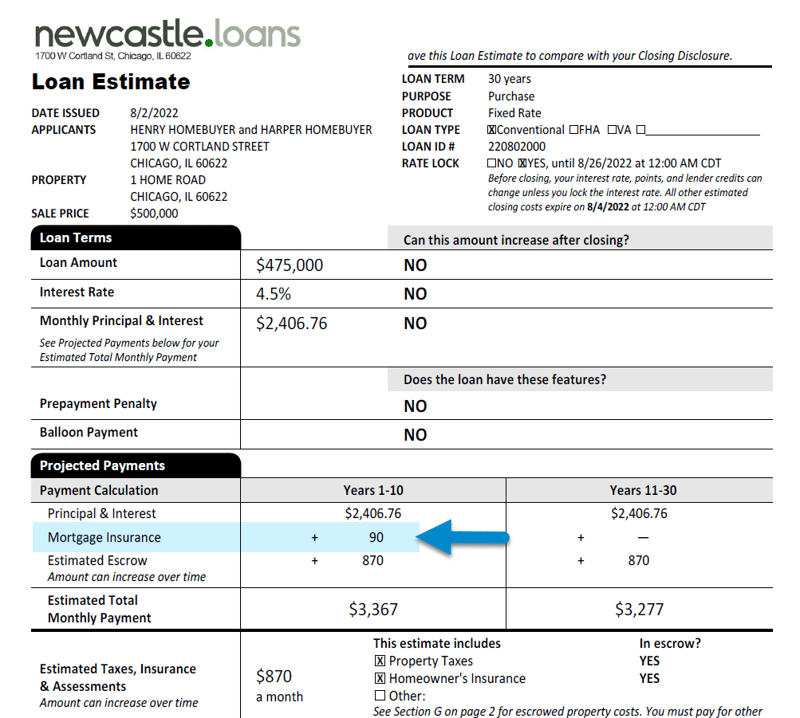

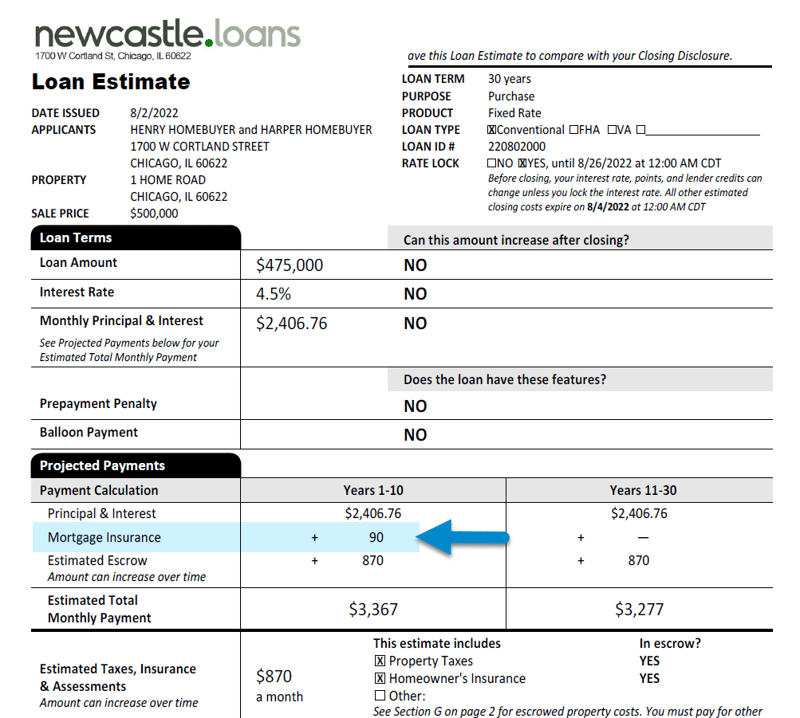

To compare, review page 1 of the lender's Loan Estimate in the Projected Payments section, where the lender shows you how much monthly PMI costs.

Check out our Loan Estimate Explainer for more information about closing costs, including mortgage insurance.

NewCastle Home Loan compares all seven PMI providers to ensure you get the cheapest PMI for your mortgage. See how much PMI costs with our PMI Calculator.

How to cancel mortgage insurance

There are three ways to cancel private mortgage insurance (PMI).

1. Request PMI cancellation.

Once you've built up 20% equity in your home, you can ask the lender to cancel your PMI and remove it from your monthly payments. Submit a written request to the lender, asking them to review it and determine whether you're eligible. They may require an appraisal to confirm your home's current value.

2. Automatic PMI termination

Suppose you're current on your mortgage payments. In that case, PMI will automatically terminate on the date when your principal balance reaches 78% of the original value of your home.

3. Refinance

You can terminate PMI by refinancing your current mortgage into a new one that doesn't require it. When refinancing, you must apply for a new mortgage and go through the loan process as you did when you bought the house, except refinancing is much easier.

Remember, you can avoid paying PMI if the loan-to-value of your new loan is 80% or less than the home's current value.

What’s the difference between PMI (Conventional) and MIP (FHA)?

PMI (Private Mortgage Insurance for conventional loans) and MIP (Mortgage Insurance Premium for FHA loans) protect the lender if you miss mortgage payments. Still, they apply to different loan types and work differently.

1. When It’s Required

-

PMI: Required for conventional loans if your down payment is less than 20%.

-

MIP: Required for all FHA loans, regardless of down payment.

2. Who Sets the Cost

3. Which Is More Expensive?

4. Can You Cancel It?

-

PMI: Can be canceled once you reach a certain loan-to-value (LTV) ratio.

-

MIP: Depending on your loan terms, it may need to be paid for the life of the loan. Can I cancel FHA MIP?