Mortgage Discount Points: Break-Even Calculator

Contents

Mortgage discount points sound like a smart way to lower your rate.

For most buyers, they are not.

Points require cash upfront, and many homeowners sell or refinance before breaking even.

This guide explains how points work, how to calculate the break-even point, and when paying points makes sense.

How do I calculate the cost and savings of mortgage discount points?

You calculate discount points as a percentage of your loan amount, then compare the upfront cost to the monthly payment savings.

One discount point equals 1% of the loan amount.

In exchange, the lender lowers your interest rate. The rate reduction varies by market and lender.

A common estimate is 0.25% per point, but it is never guaranteed.

Chicago condo purchase

Laura is buying a $400,000 condo in West Town.

She is financing $380,000 with a 30-year fixed loan.

-

Rate with no points: 6.50%

-

Rate with one point: 6.25%

-

Cost of one point: $3,800 (1% of $380,000)

Paying one point lowers her interest rate by 0.25%.

Monthly payment comparison

|

Rate |

Points |

Upfront Cost |

Monthly Payment |

|

6.50% |

0% |

$0.00 |

$2,402 |

|

6.25% |

1% |

$3,800 |

$2,340 |

|

Cost: $3,800 |

Savings: $62 |

||

By paying $3,800 upfront, Laura saves $62 per month.

Those savings add up over time.

The key question is how long it takes to recover the upfront cost.

What is the break-even for mortgage discount points?

The break-even point is the number of months it takes for your monthly savings to equal the upfront cost of the discount points.

Until you reach that point, paying points costs you money.

After that point, the lower rate creates real savings.

How to calculate the break-even point

Use this simple formula:

Cost of points ÷ Monthly payment savings = Months to break even

This calculation shows how long you must keep the loan to make points worthwhile.

Laura’s break-even timeline

Laura paid $3,800 for one discount point.

Her monthly payment dropped by $62.

$3,800 ÷ $62 = 61 months

That equals just over 5 years.

If Laura keeps the condo and loan longer than five years, the point saves her money.

If she sells or refinances sooner, she loses money.

Why break-even matters so much

Most buyers refinance or move within five years.

That timing makes discount points risky for many borrowers.

This is why points often look good on paper but fail in real life.

Want to see today’s rates with and without points side by side? Our real-time calculator instantly shows rates, payments, and closing costs.

Mortgage discount points calculator

A discount points calculator shows how long it takes for monthly savings to recover the upfront cost of buying down your rate.

This tool removes the guesswork. It tells you whether paying points helps or hurts your finances.

What the calculator shows

The calculator compares two loan options:

-

Your interest rate with points

-

Your interest rate without points

It then shows:

-

The upfront cost of points

-

Your monthly payment savings

-

Your break-even point in months and years

You see the results instantly.

Why this matters before you lock your rate

Rates change daily. So do point pricing and payment savings.

A calculator lets you test real numbers, not assumptions. You can quickly see whether paying points fits your timeline and cash flow.

This matters even more if you might refinance, move, or upgrade soon.

Should I pay points?

You should only pay discount points if you plan to keep the loan long enough to reach the break-even point.

If you sell or refinance early, paying points usually costs you money.

Use this table to help you decide

|

Consider Paying Points If... |

Don't Pay Points If... |

|

You plan to stay in the home long-term and keep the loan past the break-even point. |

You may move or refinance before reaching the break-even point. |

|

You have extra cash after the down payment and closing costs. |

Cash is tight, or you need reserves for emergencies or repairs. |

|

You choose a fixed-rate mortgage with a stable payment. |

You choose an adjustable-rate mortgage that may reset before the break-even point. |

|

You put down at least 20% and avoid mortgage insurance. |

Your down payment is under 20% and PMI increases your monthly costs. |

Why points rarely work for Chicago first-time buyers

Most Chicago buyers sell or refinance within five years. That timing often falls short of the break-even point.

Many also put down 5% to 10%. In those cases, extra cash is more effective toward a larger down payment or lower mortgage insurance.

Keeping cash in reserve also reduces stress during the first year of ownership.

A quick conversation can save you thousands. We’ll show today’s rate with and without points and help you choose the smarter option.

Do lenders ever require discount points?

Yes. Some lenders require discount points when a loan has higher risk factors.

In these cases, points are not optional.

They help the lender offset added risk.

When points are commonly required

A lender may require points if your loan includes one or more of these factors:

- Lower credit scores

- Smaller down payments

- Second homes or investment properties

- Condos or 2–4 unit properties

- Loans with a second mortgage or HELOC

Each factor increases risk. Points help the lender price that risk.

Required points scenario

Let’s say you apply for a conventional loan with:

- A 620 credit score

- A 15% down payment

- A 2-unit property

That combination raises risk. The lender may require discount points to approve the loan.

These points differ from optional rate buy-downs. You must pay them to move forward.

How to reduce the required points

You still have options.

You may ask the seller to cover discount points through a seller credit. This reduces your out-of-pocket cost at closing.

You can also compare lenders. Some price risk more aggressively than others.

For a deeper explanation, read our guide on seller credits and closing cost strategies.

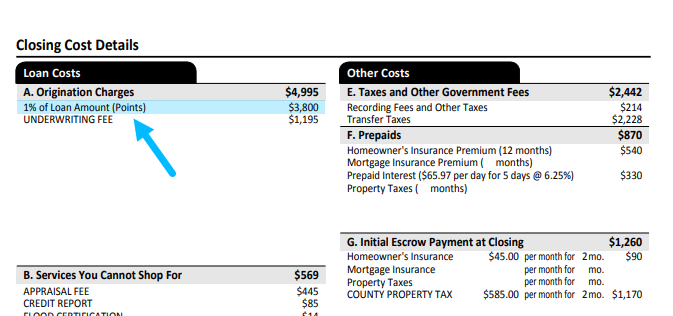

Where do I find discount points on your Loan Estimate?

Discount points appear on page 2 of your Loan Estimate, Section A: Origination Charges.

This section lists all fees you pay directly to the lender at closing.

What to look for in Section A

On page 2, review the line items under Origination Charges.

This section includes:

- Optional discount points you choose to pay

- Required points charged by the lender

- Other lender origination fees

Points are typically expressed as a percentage of the loan amount. They may also display a dollar figure alongside the percentage.

How to compare lenders correctly

Do not compare interest rates alone.

Always compare the rate and total origination charges together.

A lower rate often comes with higher points. A higher rate may require less cash upfront.

The Loan Estimate makes these tradeoffs clear when you review Section A side by side.

Know your real numbers before you commit

You should never guess what points cost.

You should see them clearly before locking your rate.

View your interest rate and full closing costs, including discount points, using our real-time calculator. You’ll know the exact cost of buying a home before moving forward.

Watch→ How to read a Loan Estimate and identify discount points

Want to see exactly where discount points appear on a real Loan Estimate and how to spot them fast?

In this short video, How to Read a Loan Estimate Like a Pro, I walk through page 2, Section A, and explain how lenders list points, origination charges, and other fees.

You’ll learn how to tell the difference between optional points and required lender charges, so you can compare offers correctly and avoid overpaying.

Watch the video to feel confident reviewing your Loan Estimate before you lock your rate.

For additional information about mortgage discount points, check the following trusted websites:

- Consumer Financial Protection Bureau: What are (discount) points?

- Freddie Mac: What you need to know about discount points

-

Loan Estimate Explainer - Mortgage closing cost comparison tool

© 2025 NewCastle Home Loans, LLC. All rights reserved.

Lending in Florida, Illinois, Indiana, and Tennessee.