Real Estate Transfer Tax Calculator | Chicago metro area

Contents

Real estate transfer taxes are fees that the state, counties, and local municipalities charge buyers and sellers when transferring property ownership.

Use our real estate transfer tax calculator to see how much these taxes cost when buying or selling a home in the Chicago metro area.

How much are the state and county transfer taxes?

In Illinois, property sellers, not home buyers, pay the state and county real estate transfer tax.

The state charges sellers $1.00 per $1,000.00 of the property's sales price. To calculate the Illinois tax, multiply the sales price by 0.10%.

All Illinois counties, including Cook, DuPage, Kane, Lake, McHenry, and Will, charge $0.50 per $1,000.00. To calculate the county tax, multiply the property's sales price by 0.05%.

Someone selling a condo in Chicago for $500,000 pays $500 to Illinois and $250 to Cook County.

- $500,000 sales price

- x 0.10% state tax = $500 Illinois transfer tax

- x 0.05% county tax = $250 Cook County transfer tax

How much are city transfer taxes in the Chicago metro area?

Municipal transfer tax rates vary based on several factors, including the property's sale price, location, and whether you're buying or selling. Taxes range from $0.00 to $10.00 per $1,000.00 of the property's sales price.

For example, Wilmette charges buyers a transfer tax, neighboring Evanston collects from sellers, and Chicago taxes buyers and sellers.

In the last section of this article, you'll find a list of the municipal real estate transfer taxes in the Chicago metro area.

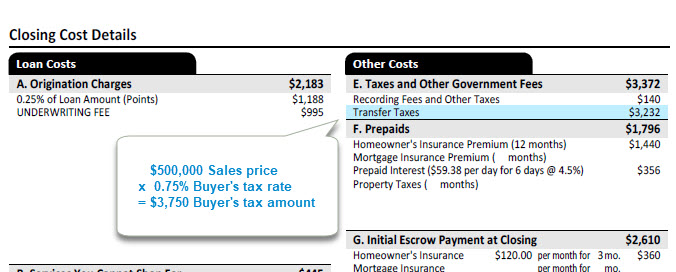

How much is Chicago's city transfer tax?

Chicago charges $10.50 per $1,000.00 for real estate sold within city limits. Buyers and sellers each pay a portion of the tax. The buyer pays $7.50 per $1,000.00, and the seller pays $3.00 per $1,000.00.

The total tax is 1.05% of the property's sales price. The buyer's share is 0.75%, and the seller's share is 0.3% of the sales price.

To calculate the buyer's Chicago transfer tax, multiply the sales price by 0.75%.

If you buy a home for $500,000

- $500,000 sales price

- x 0.75% buyer's tax

- = $3,750.00 amount the buyer pays

To calculate the seller's Chicago transfer tax, multiply the property's sales price by 0.3%.

If you sell a home for $500,000

- $500,000.00 sales price

- x 0.3% seller's tax

- = $1.500.00 amount the seller pays

Real estate transfer tax calculator

Our real estate transfer tax calculator is a simple tool that helps home buyers and sellers estimate the transfer taxes they may owe when buying or selling property in the Chicago metro area.

First, enter the property's city and sales price. Next, calculate the city, county, and state real estate transfer tax amounts. Then, double-check with the city, county, and state to confirm the taxes and fees.

Closing cost calculator with real estate transfer taxes

Use our mortgage calculator to see how much money you need to buy a home. View current interest rates, monthly payments, closing costs, and transfer taxes.

Run as many scenarios as you like as you plan for your significant purchase. Change the sales price, down payment, and loan type, and get the loan details upfront so you know what to expect.

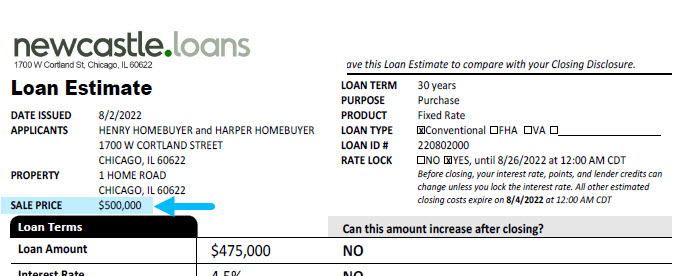

Where are transfer taxes on the Loan Estimate?

The Loan Estimate is a form the lender sends you after applying for a mortgage. It details the mortgage costs, including the real estate transfer taxes.

Check the Sales Price on Page 1 of the Loan Estimate to ensure the transfer taxes are correct.

Then, review the Transfer Tax amount on Page 2, Section E. Taxes and Other Government Fees.

The Closing Disclosure is the form the lender sends you at least three business days before closing. It lists the final numbers for your home loan, including the transfer taxes you pay at closing.

Use our free mortgage calculator to see your closing costs, including the real estate transfer tax, so you know how much money you need to buy a home.

How do I pay the real estate transfer tax?

Home buyers and sellers pay transfer taxes at closing, the final step in buying a home. Before closing, the lender gives you a bottom line: the amount of cash you need to close. Cash-to-close includes the amount you owe for real estate transfer taxes.

Next, set up a wire transfer or make a cashier's check payable to the title company overseeing the closing. Then, after signing the loan documents at closing, the title company exchanges funds, completes the transaction, and pays taxes due to the city, county, and state.

List of real estate transfer taxes for the Chicago metro area

The following table lists the real estate transfer taxes in the Chicago metro area.

| City/Town | Buyer's transfer tax | Seller's transfer tax |

| Addison | $2.50 per $1,000.00 | No transfer tax |

| Alsip | No transfer tax | $3.50 per $1,000.00 |

| Arlington Heights | No transfer tax | No transfer tax |

| Aurora | No transfer tax | $3.00 per $1,000.00 |

| Bartlett | No transfer tax | $3.00 per $1,000.00 |

| Bedford Park | No transfer tax | No transfer tax |

| Bellwood | No transfer tax | $5.00 per $1,000.00 |

| Berkeley | No transfer tax | No transfer tax |

| Berwyn | No transfer tax | $10.00 per $1,000.00 |

| Bolingbrook | $3.75 per $1,000.00 | $3.75 per $1,000.00 |

| Broadview | No transfer tax | $175.00 |

| Brookfield | No transfer tax | No transfer tax |

| Buffalo Grove | No transfer tax | $3.00 per $1,000.00 |

| Burbank | No transfer tax | $5.00 per $1,000.00 |

| Burnham | $5.00 per $1,000.00 | No transfer tax |

| $4.00 per $1,000.00 | $4.00 per $1,000.00 | |

| Calumet Park | $5.00 per $1,000.00 | No transfer tax |

| Carol Stream | No transfer tax | $3.00 per $1,000.00 |

| Channahon | $3.00 per $1,000.00 | No transfer tax |

| Chicago | $7.50 per $1,000.00 | $3.00 per $1,000.00 |

| Chicago Heights | No transfer tax | $4.00 per $1,000.00 |

| Cicero | No transfer tax | $10.00 per $1,000.00 |

| Country Club Hills | No transfer tax | $5.00 per $1,000.00 |

| Countryside | No transfer tax | No transfer tax |

| Des Plaines | No transfer tax | $2.00 per $1,000.00 |

| Dolton | No transfer tax | $5.00 per $1,000.00 |

| East Hazel Crest | No transfer tax | No transfer tax |

| Elgin | No transfer tax | No transfer tax |

| Elk Grove Village | No transfer tax | $3.00 per $1,000.00 |

| Elmhurst | No transfer tax | $1.50 per $1,000.00 |

| Elmwood Park | No transfer tax | $5.00 per $1,000.00 |

| Evanston | No transfer tax | $5.00 per $1,000. |

| Evergreen Park | No transfer tax | $5.00 per $1,000. |

|

Forest Park |

No transfer tax | No transfer tax |

| Franklin Park | No transfer tax | No transfer tax |

| Glen Ellyn | No transfer tax | $3.00 per $1,000.00 |

| Glencoe | No transfer tax | No transfer tax |

| Glendale Heights | No transfer tax | $3.00 per $1,000.00 |

| Glenwood | No transfer tax | $5.00 per $1,000.00 |

| Hanover Park | No transfer tax | $3.00 per $1,000.00 |

| Harvey | $2.50 per $1,000.00 | $2.50 per $1,000.00 |

| Harwood Heights | $10.00 per $1,000.00 | No transfer tax |

| Highland Park | No transfer tax | $5.00 per $1,000.00 |

| Highwood | No transfer tax | $5.00 per $1,000.00 |

| Hillside | $7.50 per $1,000.00 | No transfer tax |

| Hoffman Estates | No transfer tax | $3.00 per $1,000.00 |

| Indian Head Park | No transfer tax | No transfer tax |

| Joliet | No transfer tax | $3.00 per $1,000.00 |

| Justice | No transfer tax | No transfer tax |

| $4.00 per $1,000.00 | No transfer tax | |

| Lansing | No transfer tax | No transfer tax |

| Lincolnshire | $3.00 per $1,000.00 | No transfer tax |

| Lincolnwood | No transfer tax | No transfer tax |

| Lyons | No transfer tax | No transfer tax |

| Markham | No transfer tax | No transfer tax |

| Matteson | No transfer tax | No transfer tax |

| Maywood | No transfer tax | $4.00 per $1,000.00 |

| McCook | No transfer tax | $5.00 per $1,000.00 |

| Melrose Park | No transfer tax | No transfer tax |

| Mettawa | $5.00 per $1,000.00 | No transfer tax |

| Midlothian | No transfer tax | No transfer tax |

| Monee | No transfer tax | No transfer tax |

| Montgomery | No transfer tax | No transfer tax |

| Morton Grove | No transfer tax | $3.00 per $1,000.00 |

| Mount Prospect | $3.00 per $1,000.00 | No transfer tax |

| $3 per $1,000.00 | No transfer tax | |

| Niles | $3.00 per $1,000.00 | No transfer tax |

| Norridge | No transfer tax | No transfer tax |

| North Chicago | $5.00 per $1,000.00 | No transfer tax |

| North Riverside | No transfer tax | No transfer tax |

| Northlake | No transfer tax | No transfer tax |

| Oak Forest | No transfer tax | No transfer tax |

| Oak Lawn | No transfer tax | $5.00 per $1,000.00 |

| Oak Park | No transfer tax | $8.00 per $1,000.00 |

| Orland Park | No transfer tax | No transfer tax |

| Palatine | No transfer tax | No transfer tax |

| Park Forest | No transfer tax | $5.00 per $1,000.00 |

| Park Ridge | No transfer tax | $2.00 per $1,000.00 |

| Posen | No transfer tax | No transfer tax |

| River Forest | No transfer tax | $1.00 per $1,000.00 |

| River Grove | No transfer tax | No transfer tax |

| Riverdale | No transfer tax | No transfer tax |

| Riverside | No transfer tax | No transfer tax |

| Robbins | No transfer tax | No transfer tax |

| Rolling Meadows | No transfer tax | $3.00 per $1,000.00 |

| Romeoville | $3.50 per $1,000.00 | No transfer tax |

| No transfer tax | $1.00 per $1,000.00 | |

| Skokie | No transfer tax | $3.00 per $1,000.00 |

| South Holland | No transfer tax | No transfer tax |

| Stickney | No transfer tax | $5.00 per $1,000.00 |

| Stone Park | No transfer tax | $4.00 per $1,000.00 |

| Streamwood | No transfer tax | $3.00 per $1,000.00 |

| Sycamore | $5.00 per $1,000.00 | No transfer tax |

| University Park | No transfer tax | $3.00 per $1,000.00 |

| Villa Park | No transfer tax | No transfer tax |

| Wauconda | No transfer tax | No transfer tax |

| Waukegan | No transfer tax | No transfer tax |

| West Chicago | No transfer tax | No transfer tax |

| Westchester | No transfer tax | No transfer tax |

| Wheaton | $2.50 per $1,000.00 | No transfer tax |

| Wheeling | No transfer tax | No transfer tax |

| Wilmette | $3.00 per $1,000.00 | No transfer tax |

| Woodridge | No transfer tax | $2.50 per $1,000.00 |

| Worth | No transfer tax | No transfer tax |

Please note that the government may change the real estate transfer tax rates, so double-check with the city, county, and state to confirm that the taxes and fees are correct.

© 2025 NewCastle Home Loans, LLC. All rights reserved.

Lending in Florida, Illinois, Indiana, and Tennessee.