Veterans can use a VA loan to purchase a condominium, just like a single-family home. However, there is one crucial difference: the Department of Veterans Affairs (VA) must approve the condo.

Let's walk through what that means, how to check if a condo is approved, and how NewCastle Home Loans can help you close on time, even if the building isn't on the VA's list yet.

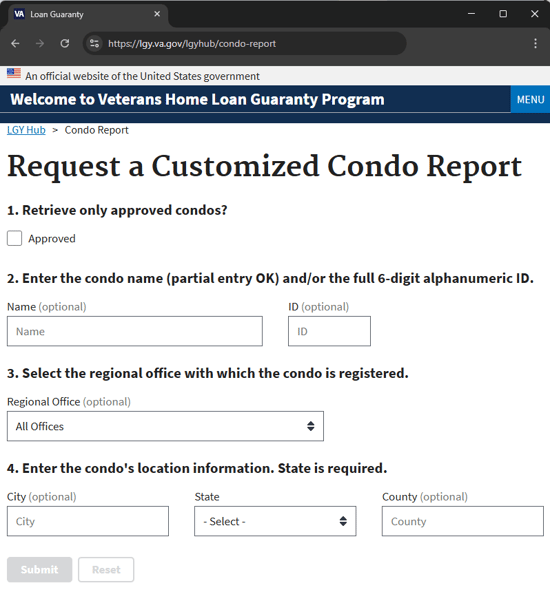

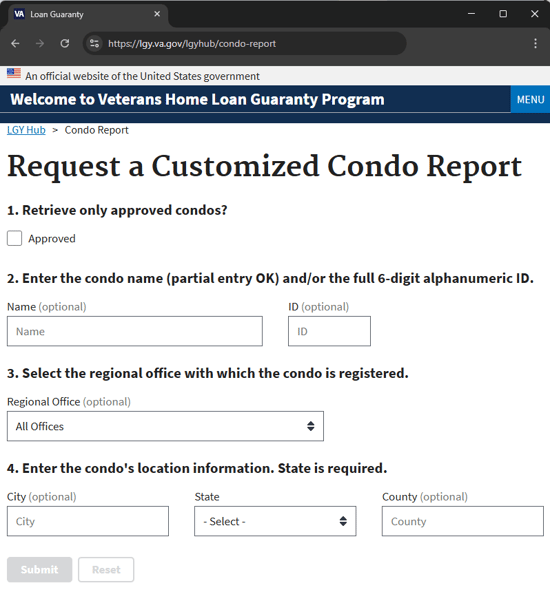

How do I know if the condo is VA-approved?

Start by checking the VA's Approved Condo List. Use the "Request a Customized Condo Report" feature to search by condo name, City, State, or County.

Many condos in the Chicago area are already VA-approved. If the one you're eyeing is on the list, great, you're ready to move forward. If it's not, that doesn't mean you're out of options. NewCastle Home Loans can help get it approved.

Take Blake, an Army veteran. He found a two-bedroom condo in Chicago's Lincoln Square neighborhood that checked every box, but it wasn't VA-approved.

The lender that pre-approved his mortgage didn't know how to get the VA to approve the condo.

Instead of walking away, he reached out to NewCastle Home Loans, and we stepped in to help.

What if the condo isn’t on the VA’s approved list?

If the condo isn't already VA-approved, NewCastle Home Loans will gather the necessary documents from the condo's homeowner's association (HOA) and submit a request to the VA on your behalf.

What we'll need from the condo HOA:

- The recorded Declaration and Bylaws

- Articles of Incorporation

- Budget and financials

- Minutes from the last two association meetings

- Current insurance certificate

Once we submit the documents to the VA, it takes them about two weeks to review and decide whether to approve the condo.

For Blake, this was great news. He applied for a VA loan with NewCastle Home Loans, and we reviewed and approved his VA eligibility, credit, and income on the same day.

Next, we gave him and his real estate agent a VA loan approval letter. The seller accepted his offer, which had a 30-day closing date.

Then, we immediately went to work, gathering the condo documents from the HOA and managing the submission to the VA.

What are the VA's condo requirements?

Here are some of the key requirements:

At least 50% of the units must be owner-occupied. VA wants to ensure the building is stable and well-managed. Too many renters can raise concerns.

In new developments, at least 75% of units must be sold or under contract before the VA will consider approval, protecting you from buying into a stalled project.

No more than 15% of units can be more than 60 days late on their dues. High delinquency rates could signal financial trouble within the building.

If the condo doesn’t meet these requirements, the VA may deny approval. But we’ll do the legwork upfront to check the building’s status and help you find alternatives if needed. Our team is experienced in reviewing these details to identify and resolve potential issues early on.

Why choose a local lender for your VA condo loan?

A local lender like NewCastle Home Loans gives you faster service, a lower rate, and expert help navigating Chicago’s VA condo process.

Buying a condo with a VA loan involves extra steps, especially if the building isn’t VA-approved yet. Big banks and national lenders often avoid these deals or can’t move quickly enough, putting your closing date at risk.

NewCastle is different. Our local team specializes in VA loans and has a deep understanding of the Chicago condo market. We’ve helped dozens of veterans get their condos VA-approved, even when the building wasn’t on the list. We coordinate with your agent, attorney, and the HOA to avoid surprises and keep your loan on track.

With us, you get responsive service, a lower rate and payment, and a smooth path to closing on time, every time.

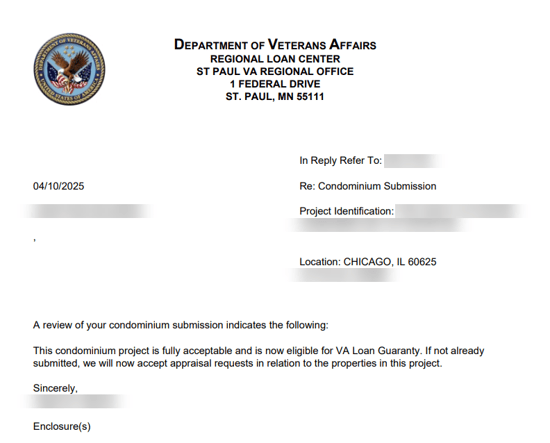

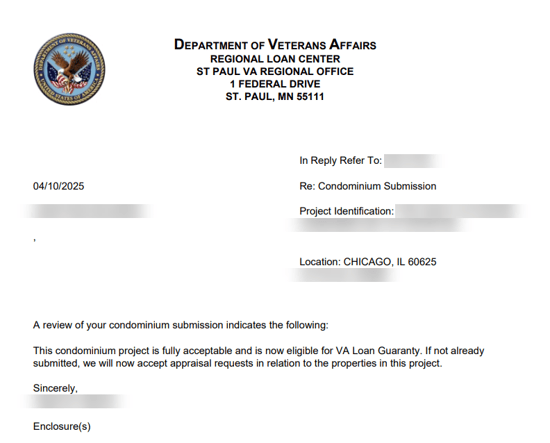

We submitted the condo documents to the VA on April 2.

The VA approved the condo on April 10, within six business days of submission.

Blake closed on his purchase on April 15, on schedule, without a hitch.

Here's the VA's approval for Blake's Lincoln Square Chicago condominium:

Step-by-step: How to buy a condo with your VA loan

Here's how we'll guide you through the process from start to finish, from pre-approval to condo research to final closing. If your dream unit isn’t on the list, we can work with the HOA and the VA to expedite its approval.

Step 1: Get Pre-Approved

We'll verify your VA eligibility, income, and credit and provide a verified pre-approval letter. You'll know exactly what you can afford before you start shopping for a condo.

Step 2: Search for a Condo

Find one you like? Send us the address. We'll check if the condo is already VA-approved. If it's not, that's okay. It just needs to meet the VA's minimum requirements. We'll work directly with your agent and the seller's agent to review the documents upfront.

Step 3: Make an Offer

We recommend setting the closing date at least 30 days from the acceptance. That gives us plenty of time to get final VA approval, underwrite your loan, and stay on schedule. You'll close on time with a low interest rate and expert guidance from start to finish.

Buying a condo with your VA loan benefit is a smart move, especially in Chicago, where condos offer location, price, and convenience. But VA approval is key.

Even if the condo you love isn't VA-approved yet, our team has the expertise to guide you through the process. We’ll handle the details so you can focus on finding your perfect home.