Prepaid items are homeowner’s insurance, mortgage interest, and property taxes you pay at closing when you buy a home.

In this article, I'll explain how to estimate the money you'll need to cover these closing costs and where to find them on the Loan Estimate. I'll also show you how to use a mortgage closing cost calculator to help with your planning so you know what to expect when you make your big purchase.

Where are prepaid costs on the Loan Estimate?

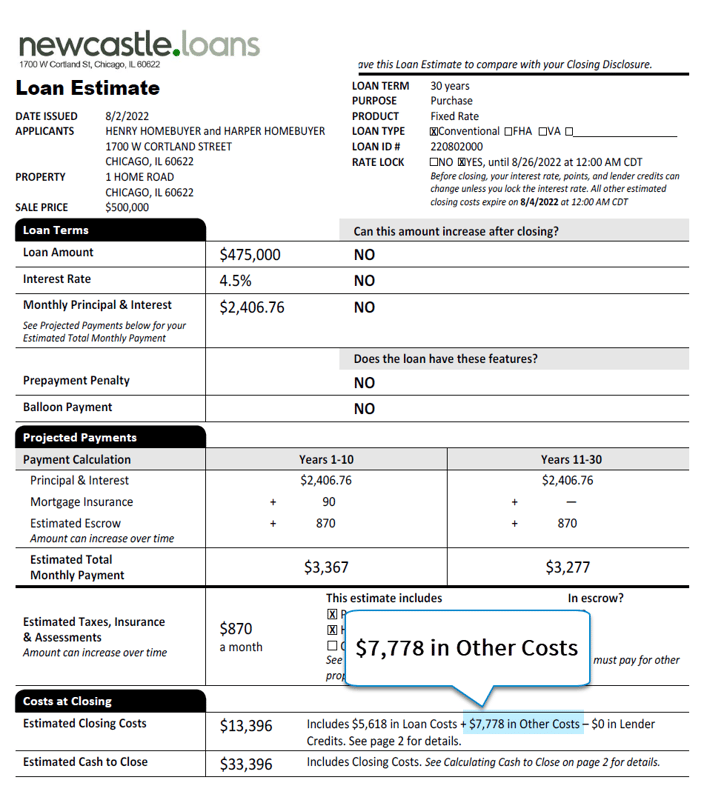

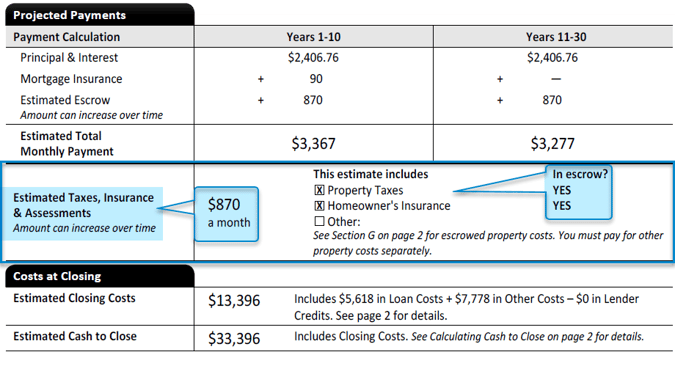

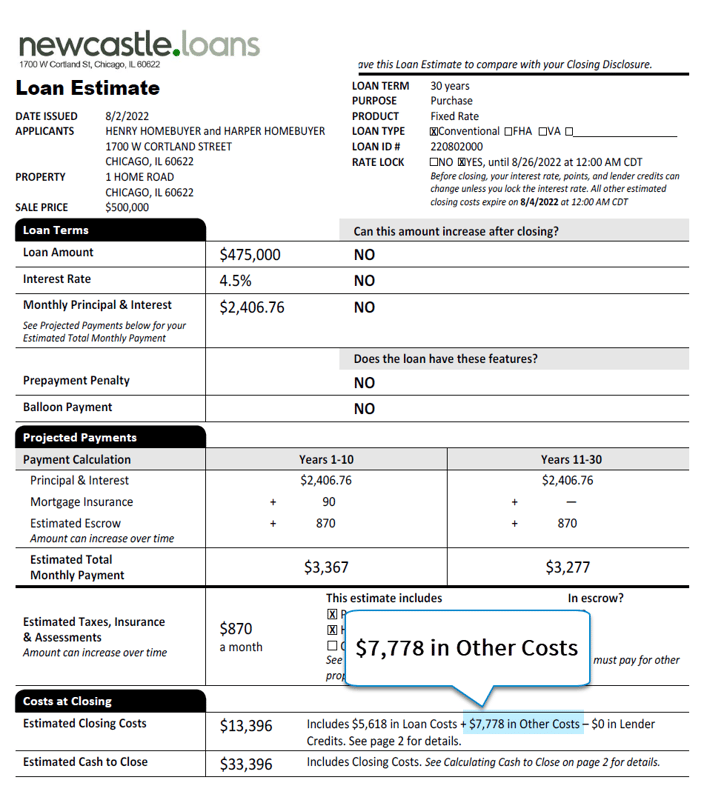

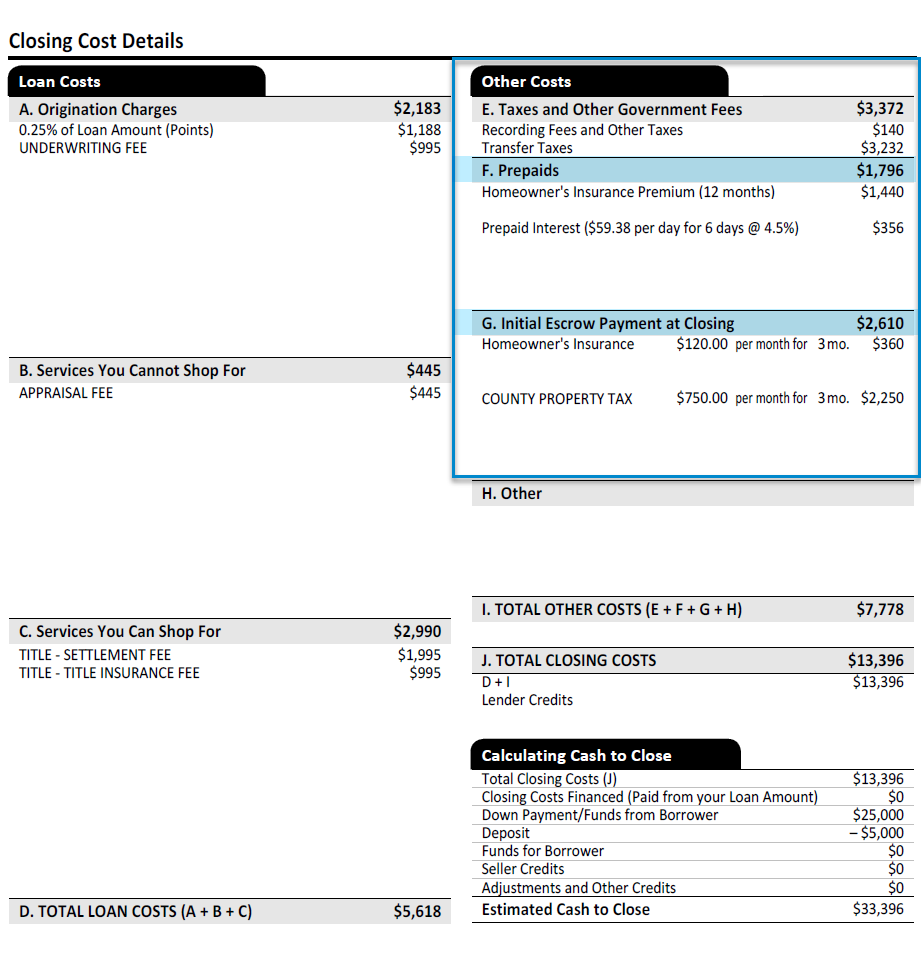

Let’s start by looking at the prepaid items on the Loan Estimate, the form the lender gives you after you apply for a mortgage. At the bottom of Page 1, the Estimated Closing Costs include “Other Costs.” The prepaid items - the insurance, interest, and taxes we’re unraveling today are Other Costs.

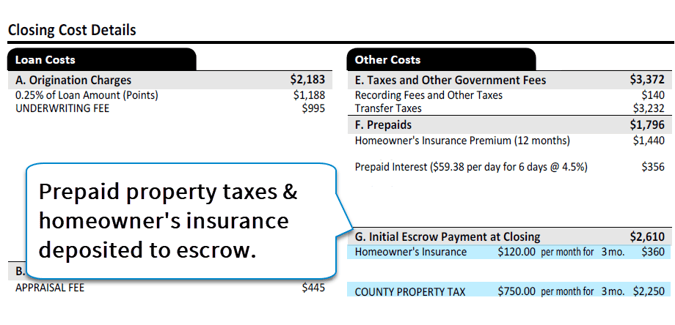

Page 2 of the Loan Estimate divides the prepaid items into two sections, Prepaids and Initial Escrow Payment at Closing.

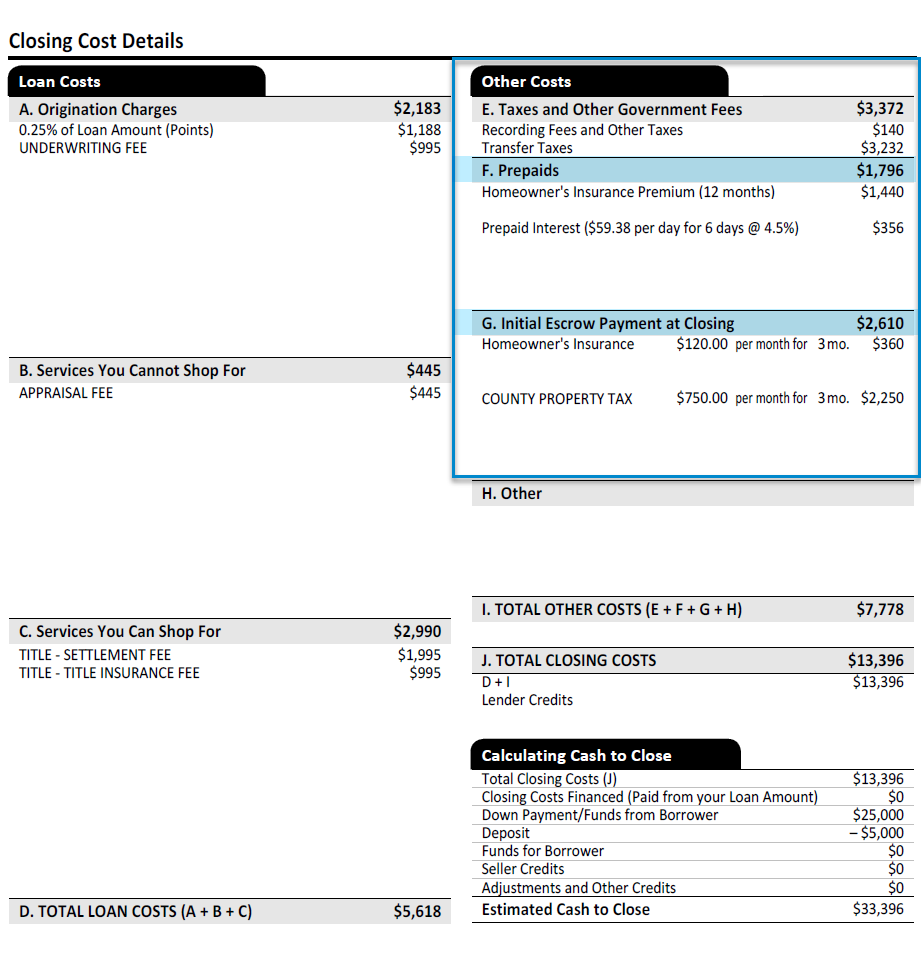

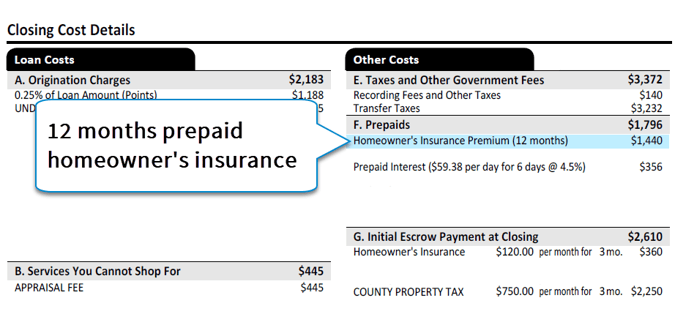

Why do I prepay homeowner’s insurance at closing?

Lenders require proof that you have homeowner’s insurance on the property. Homeowner’s insurance protects you and the lender in an accident or disaster involving your home.

Before you purchase a home, you must buy insurance that covers the property for the next 12 months. In our example, the buyer paid $1,440 for insurance coverage for one year.

Prepaid homeowner's insurance is on Page 2 of the Loan Estimate, Section F.

To satisfy the lender's requirements for homeowner's insurance,

-

Choose an insurance company. The lender does not.

-

Pay the insurance premium for the next 12 months.

-

Give the lender evidence of insurance and the paid receipt at least 1-week before you close.

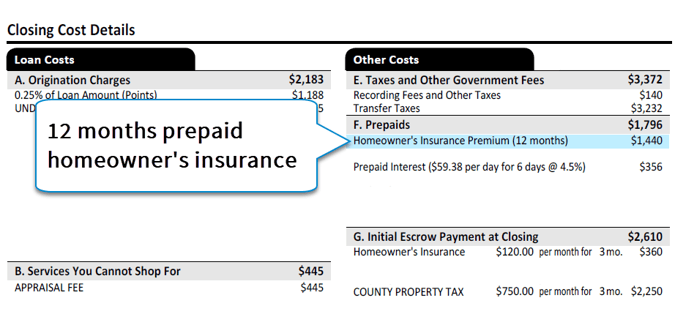

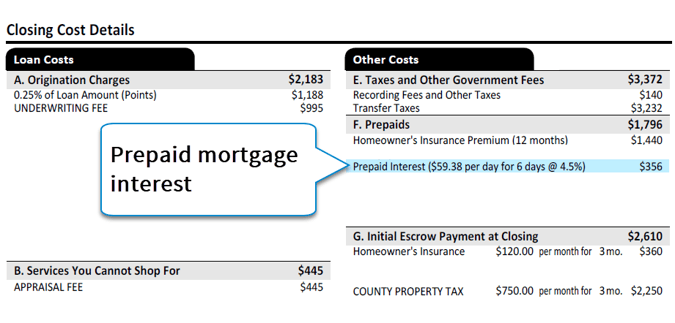

What is Prepaid Interest for a mortgage?

Prepaid Interest is mortgage interest you pay to the lender from the day you sign the loan agreement through the last day of the month. For example, the buyer closed on August 26. He prepaid interest for the 6-days left in the month. At $59.38 per day, the prepaid interest cost him $356.

Prepaid mortgage interest is on Page 2 of the Loan Estimate, Section F.

You can lower the amount of money you’ll need at closing by scheduling the closing date for the end of the month. If the homeowner in our example closed on August 1, he would prepay interest for 31 days, costing her $1,840.78. Instead, he closed at the end of the month, prepaid interest for six days, and saved $1,484.78.

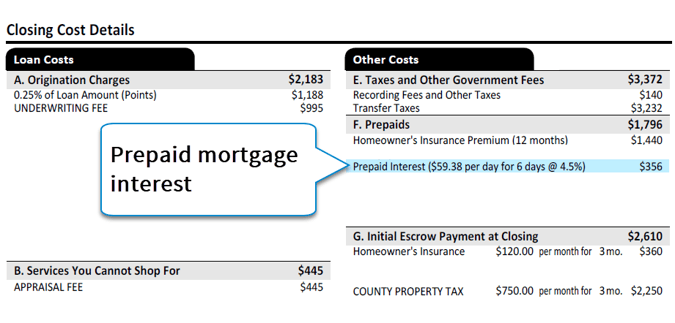

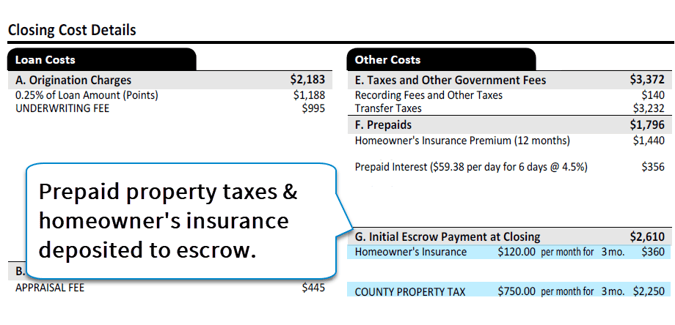

Why do I make an Initial Escrow Payment at Closing?

The initial escrow payment is the money you deposit with the lender that the lender will use to pay future homeowner’s insurance and property taxes. If you set up an escrow account, deposit three months of homeowner’s insurance and three months of property taxes when you close.

- Initial Escrow Payment = 3 months of homeowner’s insurance + 3 months of property taxes.

In the example, the buyer’s initial escrow payment is $2,610.

Initial Escrow Payment at Closing is on Page 2 of the Loan Estimate, Section G.

How do mortgage escrow accounts work?

An escrow account is a savings account the lender sets up to manage your homeowner's insurance and property tax payments.

If you escrow, the monthly payments you send to the lender include insurance and taxes. The lender deposits the insurance and tax portions into the escrow account. When the bills are due, the lender withdraws money from the account to pay them.

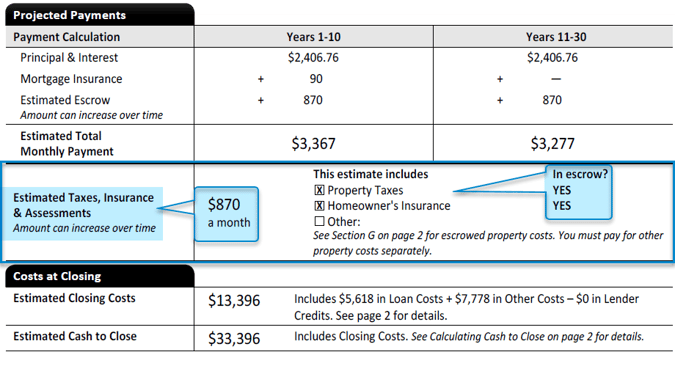

Look at the Payment Calculation on Page 1 of the Loan Estimate to see if your loan requires an escrow and how much the lender plans to put aside monthly for insurance and taxes.

Why would my mortgage payment increase after closing?

Remember the initial escrow payment, the three months deposited at closing? The lender calls it a cushion. It’s extra money that the lender holds in reserve. If your insurance or taxes increase, the lender will use the cushion to pay for it, increasing the escrow portion of your monthly payments.

On the other hand, if your insurance or taxes decrease by some miracle, the lender would lower your escrow, and your total monthly payment would decrease. Since lenders may not hold more than a 3-month cushion, you could get an escrow refund check.

Don't compare Other Costs when shopping for a mortgage.

As you shop for a mortgage, the prepaid items will differ on the Loan Estimates you get from competing lenders. In other words, the dollar amounts in sections F & G won’t match up. One lender’s estimate for homeowner’s insurance, prepaid interest, or property taxes could be much higher or lower than other estimates.

Don’t pick one lender over another just because their prepaid items are less. How much you actually prepay for insurance and taxes will end up the same no matter which lender you choose.

Lenders won’t know the insurance or tax amounts right after you apply for a mortgage. They give you approximate numbers using the information available at the time. After you select an insurance company and the seller provides the county property tax records, the lender verifies the exact amounts and sends you a revised Loan Estimate.

Get a quote from an insurance company if you want the exact numbers now. Ask your real estate agent for tax info or search the county treasurer's website.

Here are the county property tax portals in Chicagoland:

When can I waive the lender's escrow?

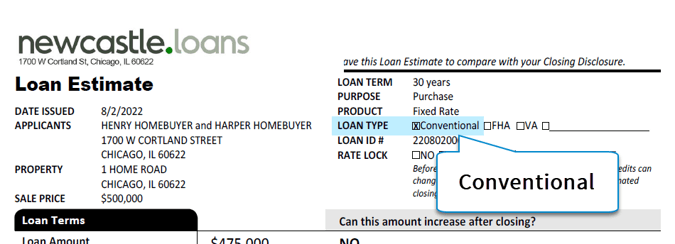

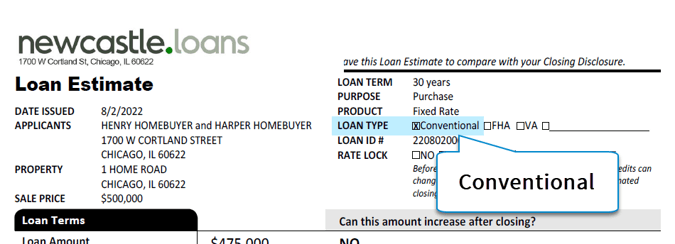

Lenders require escrow accounts for government loans, like FHA, VA, or USDA mortgages. So forget about waiving the escrow if your loan is insured or backed by our government.

But you could ask the lender to waive the escrow for a conventional loan if your down payment is 20% or more, and you can handle the lump sum payments for the annual homeowner’s insurance and property tax installments.

For instance, if you buy a place for $500,000, you could waive the escrow and manage the insurance and tax payments independently as long as the Loan Type is Conventional and your down payment is at least $100,000, 20% of the purchase price in this case.

Lenders want to manage your insurance and tax payments through an escrow account. That’s because uninsured homes and delinquent property taxes increase the risk of loss from disaster and foreclosure.

The lender might charge you a fee to waive the escrow. The fee is typically 0.25% of the loan amount. So if your loan amount is $400,000, the lender might charge you a $1,000 fee at closing to waive the escrow.

Mortgage closing cost calculator

People planning to buy homes want to know how much it will cost upfront. NewCastle Home Loans has a free mortgage calculator that instantly estimates closing costs. It’s the perfect tool for planning your big purchase.

- Enter some basic info, such as the estimated purchase price, loan amount, and your estimated credit scores.

- View an honest rate quote. You'll see the actual rate and monthly payment upfront.

- Get the details on closing costs.

Run as many scenarios as you like online, 24/7. Change the purchase price, down payment, and loan type. Then, calculate the costs based on current rates. Feel free to explore your options so you choose the right loan for the perfect home.

Check out our mortgage closing cost calculator by viewing current rates.

Prepaid items are the homeowner’s insurance, mortgage interest, and property taxes you pay when you buy a home. These costs increase the amount of money you need at closing. Look at Page 2 of the Loan Estimate, the Prepaids, and the Initial Escrow Payment at Closing sections to see how much.

The Prepaids are the homeowner’s insurance premium and mortgage interest. If you set up an escrow, you’ll make an initial payment at closing. And your monthly payments to the lender will include insurance and taxes. The lender will deposit the insurance and tax portions of your payments into the escrow account and pay the bills when they are due.

The cost for prepaid items will be the same, no matter which lender you choose. That’s because you control these costs, not the lender. You select the insurance company, the rate and day you close, and the amount of your property taxes.

Nevertheless, you should know what to expect by requesting a Loan Estimate from a lender. Most lenders, however, will check your credit report before they give you a Loan Estimate. As you know, those inquiries could lower your score.

Our Mortgage Calculator will help you plan for your significant purchase. You can see live rates, payments, and closing costs, including the prepaid items. These are the same numbers you would see on the Loan Estimate.