What is a Loan Estimate?

A Loan Estimate is a document the lender sends you outlining the costs and terms of your mortgage loan. Lenders give you a Loan Estimate within three days after applying for a mortgage. It includes essential information such as the estimated interest rate, monthly payment, closing costs, and other fees associated with the loan.

Why do I need a Loan Estimate?

A Loan Estimate helps you compare offers, understand the costs of the loan, and choose the best loan for your financial situation.

When comparing loan offers side by side, a Loan Estimate can help you measure the differences between the interest rates, monthly payments, and closing costs so you know which is best for your financial situation.

A Loan Estimate outlines the costs associated with the loan, including origination fees, appraisal fees, and other expenses to help you plan for closing.

Suppose you consider different loan types, such as fixed or adjustable mortgages. In that case, a Loan Estimate helps you compare the costs and benefits of each option so you make an informed decision about which loan fits your needs.

Is an official Loan Estimate better than a quote when shopping for a mortgage?

An official Loan Estimate is better than a quote from a lender when shopping for a mortgage for a few reasons:

- Consistency: A Loan Estimate is a standardized document. All lenders must send you one within three days of the mortgage application. The form makes comparing loan offers between lenders easier because the format is the same.

- Accuracy: Lenders must provide accurate and complete information on the official Loan Estimate. For this reason, the interest rate, closing costs, and loan terms on the Loan Estimate are more reliable than a quote.

- Protection: The Loan Estimate protects you because lenders may not increase specific fees after sending you one. As a result, you have time to shop and compare loan offers before deciding which lender to use.

An official Loan Estimate gives you more reliable, accurate, and consistent information while ensuring lenders don't take advantage of you during the mortgage process.

When can I get a Loan Estimate?

Lenders will send you a Loan Estimate within three days of the mortgage application. To receive a Loan Estimate, give the lender the following information:

- Name

- Income

- Social Security number

- Property address

- Property value

- Loan amount

Lenders require all six pieces of information to estimate the costs and terms associated with the loan accurately. For example, the loan's interest rate and monthly payments depend on your credit score and income, which the lender can determine after you apply.

When should I shop for mortgage rates as a home buyer?

Start shopping for a mortgage when you're "under contract" to buy a house. Under contract means you made an offer on the property, and the seller accepted it.

To shop for a mortgage, research and compare offers from a few lenders to find the best mortgage loan for your needs. Here are some steps to follow when shopping for a mortgage:

- Find a reliable mortgage lender. Start with the lender that did your mortgage pre-approval letter.

- Ask for an official Loan Estimate. Ask a few mortgage lenders for a Loan Estimate to shop for a mortgage. Review it carefully and compare it with other offers from different lenders to ensure you're getting the best deal possible.

- Lock the interest rate. Mortgage rates frequently fluctuate, so getting Loan Estimates on the same day is a good idea. Then, once you've found a lender and mortgage product you're comfortable with, lock in your interest rate to protect against sudden increases before closing on your new home.

Am I committed to the mortgage after signing the Loan Estimate?

Signing the Loan Estimate does not commit you to the lender. Instead, the Loan Estimate outlines the costs and terms of the mortgage.

While signing the Loan Estimate indicates that you have received and reviewed the document, it does not obligate you to accept the loan.

However, signing it tells the lender to proceed with the loan process. As a result, the lender may begin processing the paperwork, including a property appraisal report and other verifications, to determine whether you meet the loan requirements.

Can the lender change the Loan Estimate before closing?

Lenders may only change the numbers on the Loan Estimate when you request changes or certain unforeseen circumstances arise.

For example, suppose your home's appraised value is lower than expected. As a result, the lender must increase the interest rate and lower the loan amount they offered you initially. The lender will send you a revised Loan Estimate within three days after changing your loan.

"NewCastle helped me get my first mortgage, and I recommend them very highly. Incredible customer service, super responsive, and played a huge role in..."

"My experience with New Castle Home Loans and Jim's team was nothing short of outstanding. They provided me with a home loan that was tailored to my family's needs, and the entire process was incredibly easy-going and hassle-free..."

"Fastest and most reliable service I have ever had and heard. I am especially thankful for Jim Quist for his knowledgeable and caring service. His service was above and beyond..."

"I have done three mortgages with new castle. Perfect efficincy and super happy to work with them again."

"The NewCastle team helped us achieve our long-time goal of becoming homeowners. I never dreamed closing on a home could go so smoothly for us. They were..."

"Highly recommended! Jim and his entire time were friendly, helpful, and responsive. I'm glad I worked with this business, who has an office right here in the city and understands the intricacies of the Chicago market."

"It’s been a absolute pleasure working with the New Castle team for the 2nd time, I can’t say enough good things about this company..."

"I worked with Jim last year and worked with him again this year as well. Jim was very helpful, and is very obvious that he..."

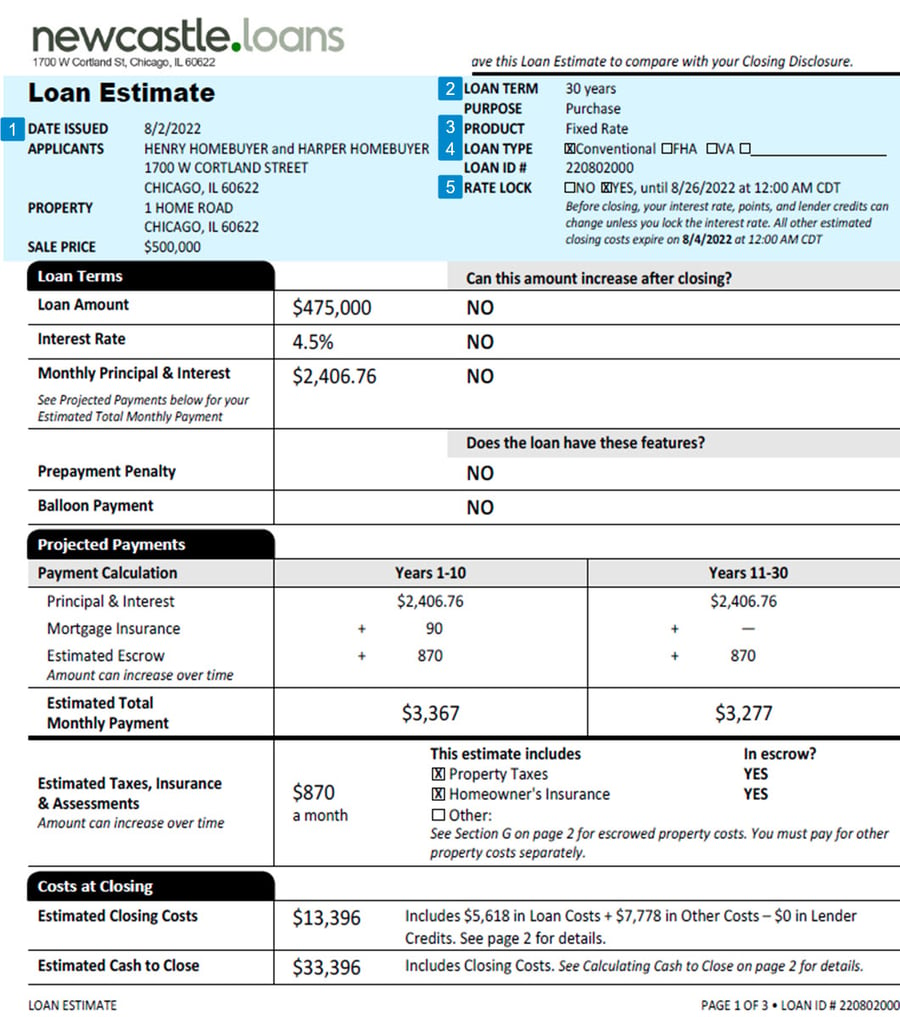

Loan Estimate, Page 1 of 3

A Loan Estimate is a form you receive from the lender after applying for a mortgage. It includes the details about your home loan, such as the monthly payment, interest rate, and closing costs.

-

Date Issued:

After you apply for a mortgage, the lender will send you a Loan Estimate within three days.

-

Loan Term:

The loan term is the number of years you have to repay the loan. The term affects the monthly payment, the interest rate, and how much interest you'll pay over time. 30-year and 15-year terms are the most common.

-

Loan Product:

The loan product can be either a fixed or adjustable rate mortgage. With a fixed-rate mortgage, the interest rate and monthly payment of principal & interest will stay the same. However, the interest rate and monthly payment for an adjustable-rate mortgage (ARM) can change after closing.

-

Loan Type:

We offer Conventional, FHA, VA, and USDA loans. Most homebuyers with excellent credit go for a conventional loan, a low-cost mortgage with a minimum down payment of only 3%. An FHA loan is an affordable mortgage even when your credit isn't perfect. Get approved with a 3.5% down payment and a 600 credit score. With a VA loan, a servicemember, veteran, or eligible surviving spouse can buy a home with no down payment, no mortgage insurance, and a favorable rate. A USDA loan helps you buy a home in a rural area with no down payment.

-

Rate Lock:

A rate lock is an agreement between you and the lender. The lender agrees to give you an interest rate with certain fees for a specific time. In return, you agree to accept the lender's offer and close the loan before the lock expires. Contact the lender to lock the interest rate after applying for the loan but before closing. Learn more about locking your interest rate.

Loan Terms are the mortgage details, such as the loan amount, interest rate, and monthly principal and interest payment. We will send you a revised Loan Estimate if the loan terms change before closing.

-

Interest Rate:

The interest rate is the price you pay to borrow money. View current mortgage rates on our website now.

-

Monthly Principal & Interest:

Lenders calculate Monthly Principal & Interest payments based on the loan amount, term, and interest rate. The principal portion repays the loan, while the interest is the price you pay for borrowing the money.

-

Prepayment Penalties:

We never charge Prepayment Penalties, a fee for paying off all or part of your loan early.

-

Balloon Payments:

We don't offer loans with Balloon Payments. A balloon loan has a final payment at the end of the loan term that is higher than previous payments.

The Projected Payments table estimates your monthly housing payments for the loan term. In addition, you can see if the lender requires mortgage insurance, and they will manage your property tax and homeowner’s insurance payments through an escrow account.

-

Mortgage Insurance:

You may have to pay mortgage Insurance, depending on the loan type and the amount of your down payment. Compare the cost of mortgage insurance when shopping for a mortgage. Some lenders charge more than others for mortgage insurance. Conventional mortgage insurance. FHA mortgage insurance.

-

Estimated Escrow:

Estimated Escrow is the portion of your monthly payments that the lender collects to pay your homeowner's insurance and property tax bills. The amounts can change depending on how much you pay for homeowner's insurance and property taxes. Learn more about an escrow account.

-

Estimated Total Monthly Payment:

Estimated Total Monthly Payment is the amount you'll pay the lender each month. The four main components of a mortgage payment are the Principal, Interest, Taxes, and Insurance (PITI). Learn more about your monthly payment.

-

This Estimate Includes:

The lender will set up an escrow account to manage payments for property taxes and homeowner’s insurance when the boxes are marked “Yes.”

The Costs at Closing table shows Estimated Closing Costs and Estimated Cash to Close.

-

Estimated Closing Costs:

Estimated Closing Costs are Loan Costs plus Other Costs minus Lender Credits. See page 2, Closing Costs Details, for a breakdown. -

Estimated Cash to Close:

Estimated Cash to Close is the money you'll need at closing when you buy the home. The amount may change. If it does, the lender will provide a revised Loan Estimate so you're well-informed every step of the way. See page 2, Calculating Cash to Close, for details.

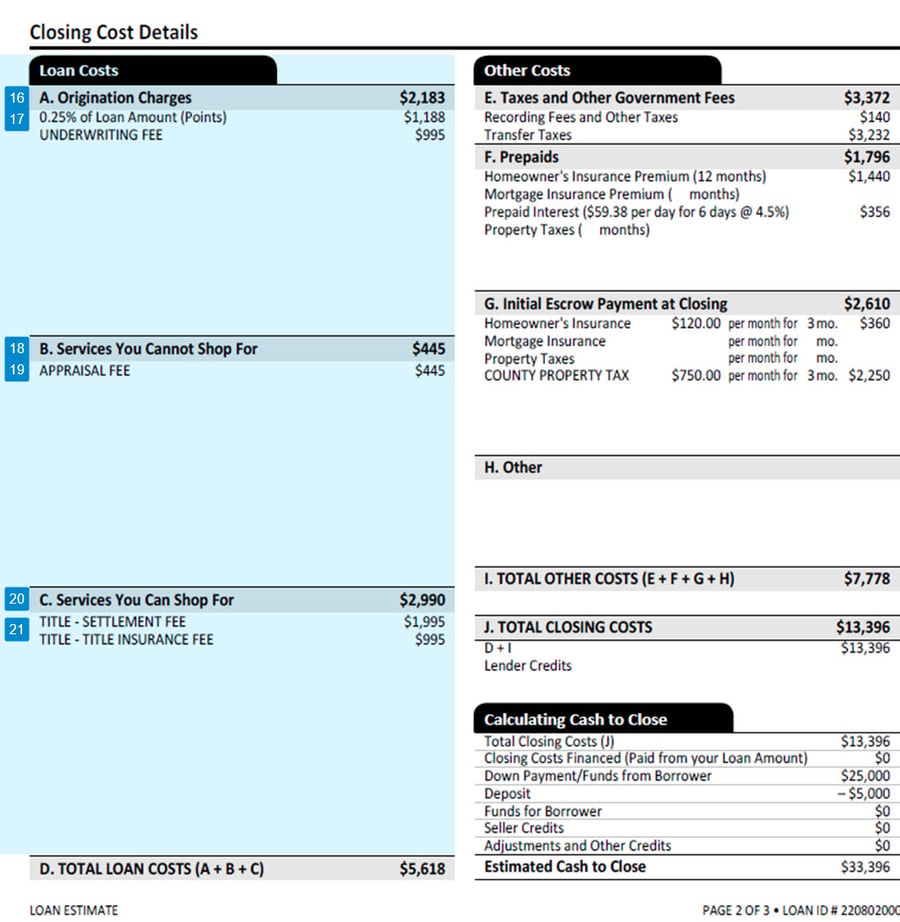

Loan Estimate, Page 2 of 3

Loan Costs are fees you pay to the lender and third parties. Add up the costs in sections A and B to determine how much the lender charges you for the loan.

-

Origination Charges:

Origination Charges are fees paid directly to the lender at closing. Compare the overall origination charges when shopping for a mortgage. Some lenders charge fees for Underwriting, Processing, Administration, etc. A lower-interest-rate mortgage may have higher origination charges or vice versa. -

Discount Points:

Points or "discount points" are fees paid to the lender to reduce the interest rate on your home loan. Points allow you to spend extra upfront at closing to lower the monthly payment and save money over time. Learn more about discount points. -

Services You Cannot Shop For:

The lender may order third-party services and pass the fees on to you. For example, we may request a property appraisal from an approved appraiser and ask you to pay for it. Some lenders charge more for these services than others. Or they may throw in fees for a credit report, flood determination, or tax search. So, compare the total cost of the "Services You Cannot Shop For" when shopping for a mortgage. -

Appraisal Fee:

An appraisal is a report completed by a real estate appraiser on the home's fair market value based on recently sold comparable properties in the area. The lender uses the appraisal or the home's sales price, whichever is less, to determine the property's value. The lender orders the report and asks you to pay the fee upfront. In any case, because you can't select an appraiser, the lender can't increase the appraisal fee after you receive the Loan Estimate. -

Services You Can Shop For:

The lender may require additional third-party services, like title insurance. "Services You Can Shop For" means you can pick the companies to perform the services, pay the fees they charge, and lower your loan costs. Please don't just compare the overall cost in this section when shopping for a mortgage. Like most homebuyers, you'll likely use alternative service providers to ensure the price remains the same. -

Title Fees:

Title Fees are the estimated costs for title insurance, settlement fees, and other services provided by the lender's title company. If the lender orders the title work through their service provider, you'll pay the amounts listed on the Loan Estimate. Most likely, however, you'll use the title company the seller, real estate agent, or attorney recommends. So the cost of title services will change.

Other Costs are taxes, government fees, and prepaid items. These fees may vary on the initial Loan Estimates you receive from lenders. Lenders may not know the exact amounts when you first apply, like how much you'll pay for property taxes. They will update the numbers before closing. You'll pay the same charges at closing when you buy a home, no matter which loan you choose. So don't compare these fees when shopping for a mortgage.

.jpg?width=900&height=1020&name=Loan%20Estimate%20Page%202%201%20Other%20Costs%20Newcastle%20Loans%20(2).jpg)

-

Recording Fees and Other Taxes:

Pay Recording Fees and Other Taxes to the county at closing. The county keeps track of all purchases and sales. -

Transfer Taxes:

Transfer Taxes are a one-time fee paid at closing to a city, county, or state. The amount varies depending on where the property is. However, the cost will be the same regardless of the loan or lender you use to buy a home. Find out how much with our Transfer Tax Calculator. -

Prepaids:

Prepaids are the homeowner's insurance and mortgage interest you pay at closing when you buy a home. Learn more about prepaid items. -

Homeowner's Insurance Premium:

Lenders require proof that you have homeowner's insurance on the property to protect you and the lender in case of an accident or disaster involving your home. The amount on the Loan Estimate is a ballpark figure. Before purchasing a home, select an insurance provider, pay the annual Homeowner's Insurance Premium, and send us proof of insurance. Learn more about Homeowner's Insurance. -

Prepaid Interest:

Prepaid Interest is mortgage interest you pay to the lender from the day you sign the loan agreement through the last day of the month. -

Initial Escrow Payment:

Initial Escrow Payment at Closing is the money you deposit with the lender that the lender will use to pay future homeowner's insurance and property taxes. If you set up an escrow account, deposit two months of homeowner's insurance and 2-months of property taxes when you close. Your monthly mortgage payments will include insurance and taxes. The lender will save the insurance and tax portions in the escrow account. Then, when the bills are due, the lender will pay them for you from the money saved in the escrow account. -

Lender Credits:

Lender Credits are the amount of money the lender will contribute at closing to pay your closing costs. The lender can pay all or a portion of your closing costs. However, the contribution cannot be more than the actual closing costs.

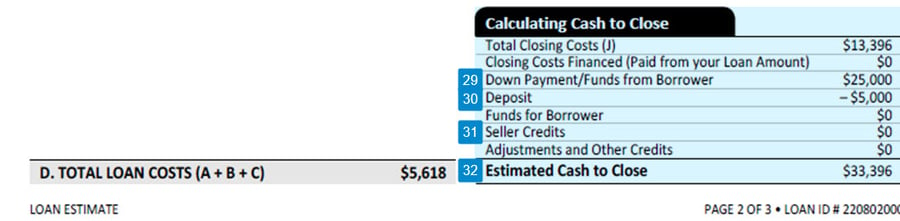

In the Calculating Cash to Close table, the lender estimates the cash you’ll need at closing.

-

Down Payment:

A Down Payment is money you pay upfront to buy a house. You'll need a down payment of at least 3% for a conventional loan and 3.5% for an FHA loan. You don't need a down payment when using a VA or USDA loan to buy a home. -

Deposit:

Deposit or earnest money is the cash you put up as security to show the seller you're serious about buying a home. The amount depends on how much the seller will accept to take the property off the market. The average good faith deposit is between 1% and 3% of the property's purchase price. After signing the real estate sales contract, make a check or wire transfer payable to a third party, such as the real estate attorney, realtor, or title company. The third party will hold the money in a trust account until closing. Then, subtract the earnest money from the estimated cash to close. Learn more about your deposit. -

Seller credits:

Seller credits are the funds the seller kicks in to pay your closing costs. Asking the seller to pay your closing costs is an excellent way to reduce the amount of money you'll need at closing when you buy a home. How much depends on your agreement with the seller. Negotiate the seller's credits upfront when offering to buy the house. Typically, the limit is 3% - 6% of the sales price of the property or the total amount of the closing costs, whichever is less. Learn more about seller credits. -

Estimated Cash to Close:

Estimated Cash to Close is the money you'll need at closing when you buy the home. It includes the down payment plus the closing costs minus any earnest money and seller credits. Your cash-to-close may change. If it does, we'll provide a revised Loan Estimate so you're well-informed every step of the way.

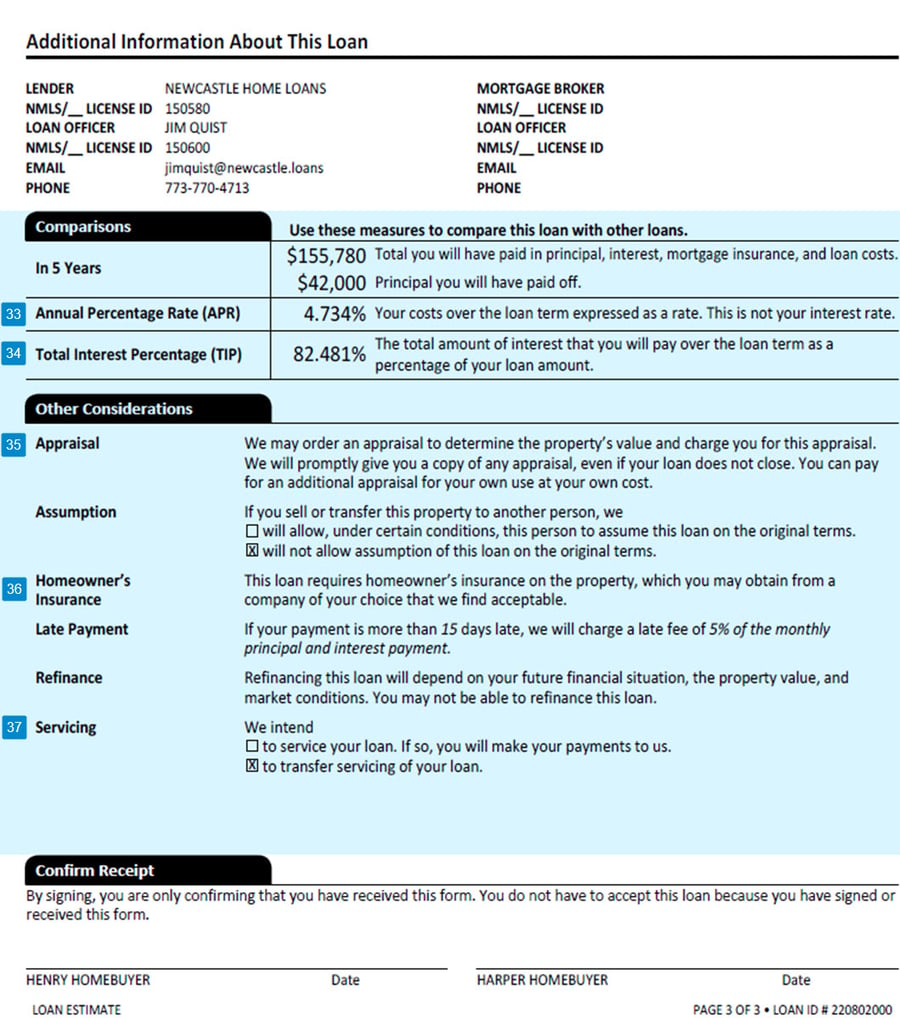

Loan Estimate, Page 3 of 3

The Comparisons table gives you three ways to compare the loan cost: in 5 years, as an annual percentage rate, and as a total interest percentage.

-

APR:

APR is the annual cost of the loan, including the interest rate and fees such as mortgage insurance, origination charges, and some title fees. The APR is usually higher than the interest rate because it includes other costs. The APR gives you more information about the overall cost of the loan. -

Total Interest Percentage (TIP):

Total Interest Percentage (TIP) tells you how much interest you'll pay over the loan term. We calculate the TIP by adding the interest payments and dividing the total by the loan amount to get a percentage. -

Appraisal:

An appraisal is a report completed by a real estate appraiser on the home's fair market value based on recently sold comparable properties in the area. The lender uses the appraisal or the home's sales price, whichever is less, to determine the property's value. The lender orders the report and asks you to pay the fee upfront. However, because you can't select an appraiser, the lender can't increase the appraisal fee after you receive the Loan Estimate. -

Homeowner's Insurance:

Lenders require proof that you have homeowner's insurance on the property to protect you and the lender in case of an accident or disaster involving your home. -

Servicing:

Servicing is collecting and tracking your monthly payments, managing your escrow account, and providing customer service. NewCastle Home Loans will transfer the serving of your loan to a well-known bank or loan servicer with first-rate customer service.