When you apply for a mortgage, your Notice of Intent to Proceed tells the lender you’re ready to move forward.

It’s a simple but important step that keeps your loan and your home purchase on track.

What does “Intent to Proceed” mean in a mortgage?

Your intent to proceed indicates to the lender that you’re ready to move forward with your loan. It’s your official “yes” after comparing offers.

Here’s how it works:

- Apply for a mortgage. You can apply with one or more lenders.

- Review Loan Estimates. Within three business days, each lender will send a three-page Loan Estimate showing your rate, payment, and costs. [Check out our Loan Estimate Explainer.]

- Choose your lender and confirm your intent to proceed. This step gives your chosen lender permission to start processing your loan.

Once sellers accept your offer, it’s time to apply and decide which lender you’ll trust to handle your mortgage.

How do I notify the lender of my intent to proceed with a mortgage?

Let your lender know you’re ready to move forward by calling, emailing, or texting your loan officer within ten days of receiving your Loan Estimate.

Clear communication matters. If you don’t respond, the lender may assume you chose another company and close your file.

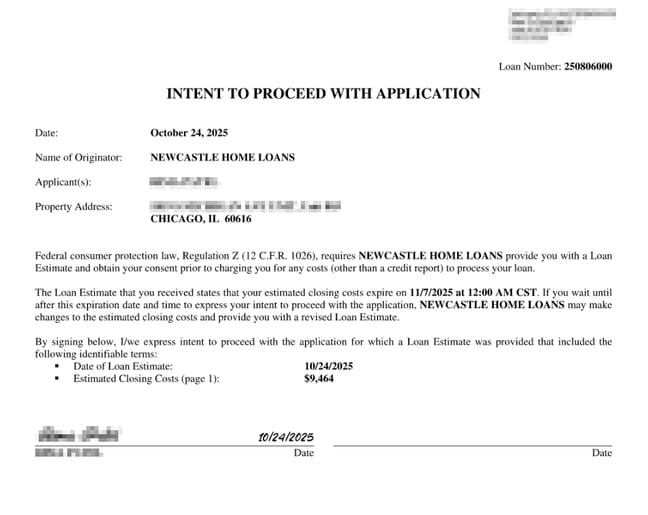

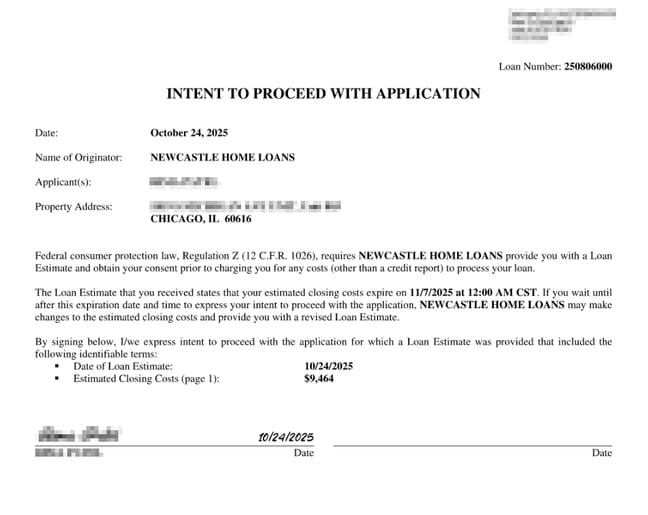

Most lenders include an Intent to Proceed form with the Loan Estimate. Signing and returning this form confirms that you accept the terms and wish to proceed with the mortgage process.

Here's what the Intent to Proceed form looks like.:

Can I still cancel my loan after submitting my Intent to Proceed?

Yes. Providing a lender with your Intent to Proceed lets them know you intend to proceed with the loan process. You’re not obligated to close the loan and can cancel your application at any time before signing the final documents at closing.

If you decide not to continue, there’s no need to contact the lender to cancel. Your application will automatically close after 30 days of inactivity.

At NewCastle Home Loans, we make the process transparent and straightforward. Just reply to your loan officer or sign our form to confirm your intent, and we’ll start processing your loan right away, keeping your purchase on track and stress-free.

Buying a home is a significant financial step, and our team is here to guide you from application to closing with clear communication and dependable service.

Get the lowest mortgage rate and close on time.

If you’re shopping for the best deal, NewCastle Home Loans makes it easy to compare your options.

View current rates, complete a quick application, and we’ll send you a Loan Estimate today, showing your exact rate, payment, and closing costs- no surprises.

We offer the lowest 30-year fixed mortgage rates in Chicago thanks to our lean business model and local expertise.

Our in-house team will close your loan in as little as 14 days, providing buyers with confidence even under tight deadlines.

Save money. Close fast. Feel confident about your mortgage.