"NewCastle helped me get my first mortgage, and I recommend them very highly. Incredible customer service, super responsive, and played a huge role in..."

"My experience with New Castle Home Loans and Jim's team was nothing short of outstanding. They provided me with a home loan that was tailored to my family's needs, and the entire process was incredibly easy-going and hassle-free..."

"Fastest and most reliable service I have ever had and heard. I am especially thankful for Jim Quist for his knowledgeable and caring service. His service was above and beyond..."

"I have done three mortgages with new castle. Perfect efficincy and super happy to work with them again."

"The NewCastle team helped us achieve our long-time goal of becoming homeowners. I never dreamed closing on a home could go so smoothly for us. They were..."

"Highly recommended! Jim and his entire time were friendly, helpful, and responsive. I'm glad I worked with this business, who has an office right here in the city and understands the intricacies of the Chicago market."

"It’s been a absolute pleasure working with the New Castle team for the 2nd time, I can’t say enough good things about this company..."

"I worked with Jim last year and worked with him again this year as well. Jim was very helpful, and is very obvious that he..."

What is a Real Estate Sales Contract?

A real estate sales contract is a legal agreement between you, the buyer, and a seller that outlines the terms and conditions of a real estate transaction. It includes important details such as the purchase price, closing date, and contingencies.

When you find a place you want to buy, you and your real estate agent research the market by looking at comparable homes to determine a fair price to offer the sellers.

Next, your agent writes a purchase offer using a real estate sales contract. It includes the purchase price, closing date, contingencies, and any other terms and conditions you want to have.

Then, submit the offer, including an updated mortgage pre-approval letter, to the sellers. The lender's pre-approval letter shows the sellers that you're a serious buyer and have the financial means to purchase the home.

The sellers may counter, and you may continue negotiating until you reach an agreement. After agreeing to the terms, you and the sellers sign the sales contract, making it a legally binding agreement.

After that and before closing the deal, you meet the contingencies outlined in the contract, like the home inspection, attorney review, and mortgage commitment.

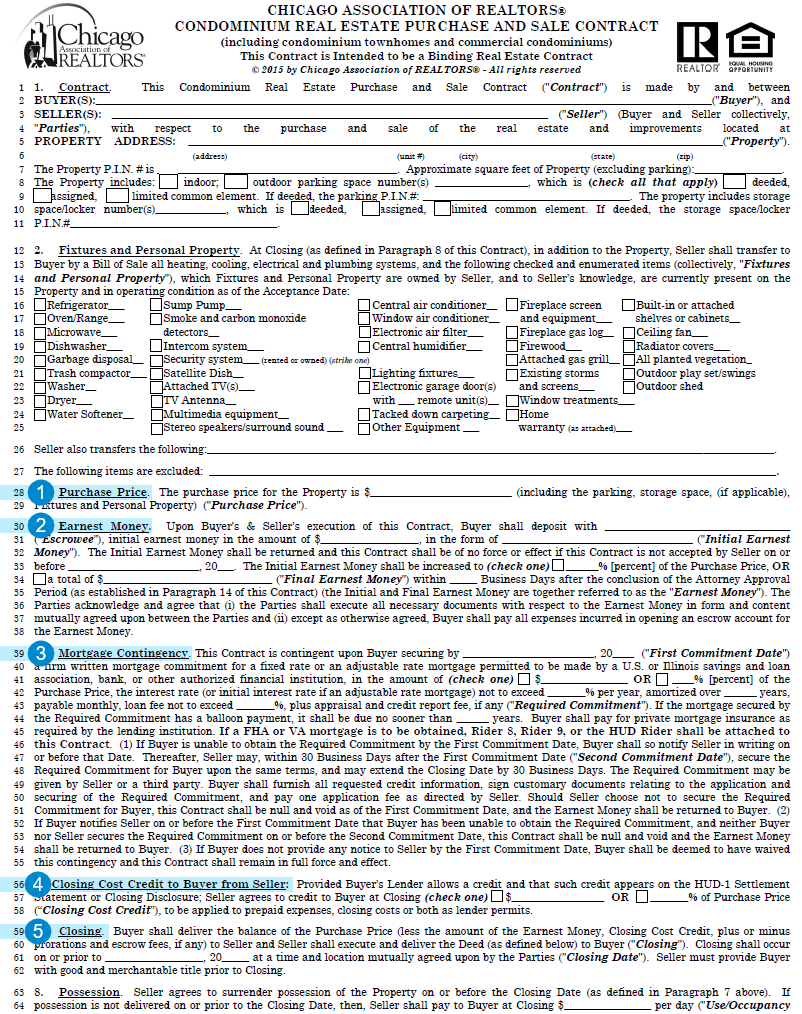

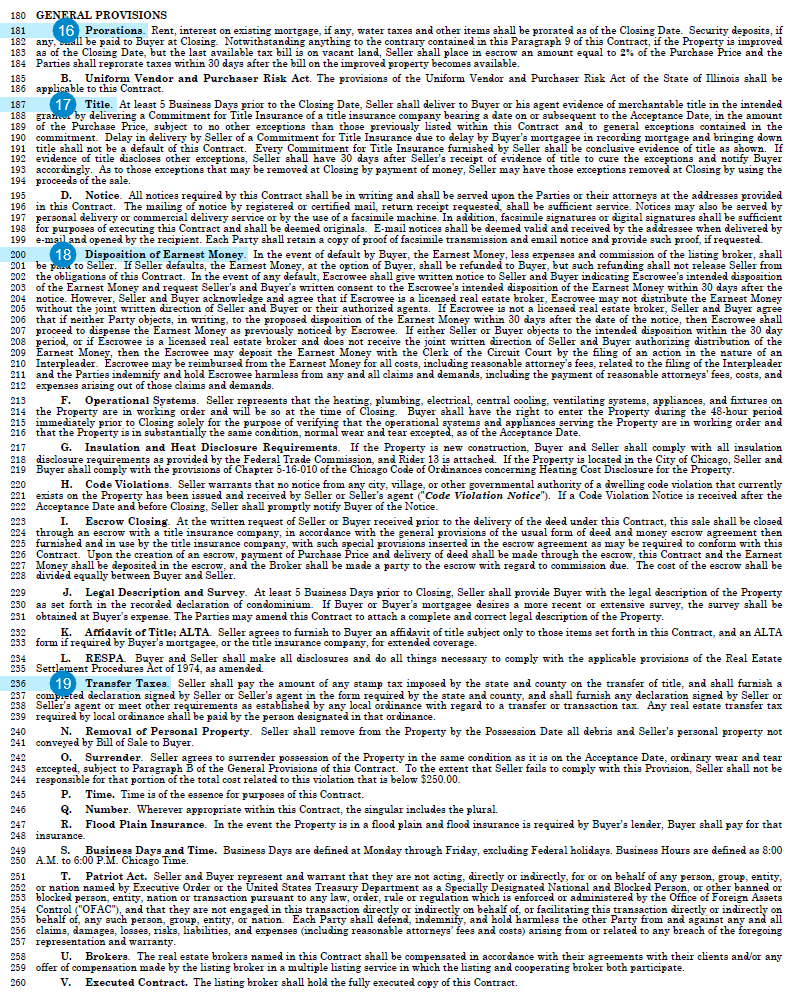

Sales Contract, Page 1 of 4

-

Purchase Price:

The purchase price is the amount you agree to pay the seller for the property per the sales contract. The purchase price may be a fixed amount, or it may be negotiable and subject to change based on various factors such as the property's condition, location, and current real estate market.

You pay the seller the purchase price in installments. First, you pay earnest money when you sign the contract. Then, at closing, you make the rest of the down payment and finance the remaining purchase price balance through a mortgage loan. -

Earnest Money:

Earnest money is your "good faith deposit" when entering a real estate sales contract. It is typically a small percentage of the purchase price that shows the seller you're serious about purchasing the property. If the sale goes as planned, the seller credits the earnest money toward the purchase price. However, if the deal does not go through, the contract determines the fate of the earnest money. -

Mortgage Contingency:

A mortgage contingency allows you to back out of the contract and get your earnest money back if you can't get a mortgage to buy the property. -

Closing Cost Credit to Buyer from Seller:

A seller credit or closing cost credit is when the seller agrees to pay some or all of your closing costs. Closing costs are fees and expenses associated with purchasing a property, like a lender, appraisal, and title fees. They can add up to several thousand dollars, so a seller credit can make buying a home more affordable. -

Closing:

The closing, also known as a "settlement," is the final step in buying a home. It is the point at which the seller transfers the ownership of the property to you, and you complete all of the financial transactions related to the purchase.

During the closing, you and the sellers (or your representatives) meet at a designated location, such as a title company or real estate attorney's office. At the closing, you sign the loan agreement, mortgage documents, and other legal documents required by the state and local government. Next, you pay the remaining purchase price balance to the seller, typically through a wire transfer or certified check.

Then, the seller pays off any outstanding mortgages or debts against the property and transfers ownership to you by signing the deed. After that, the seller hands you the key to your new home.

Use our closing cost calculator to view current rates, payments, and closing costs.

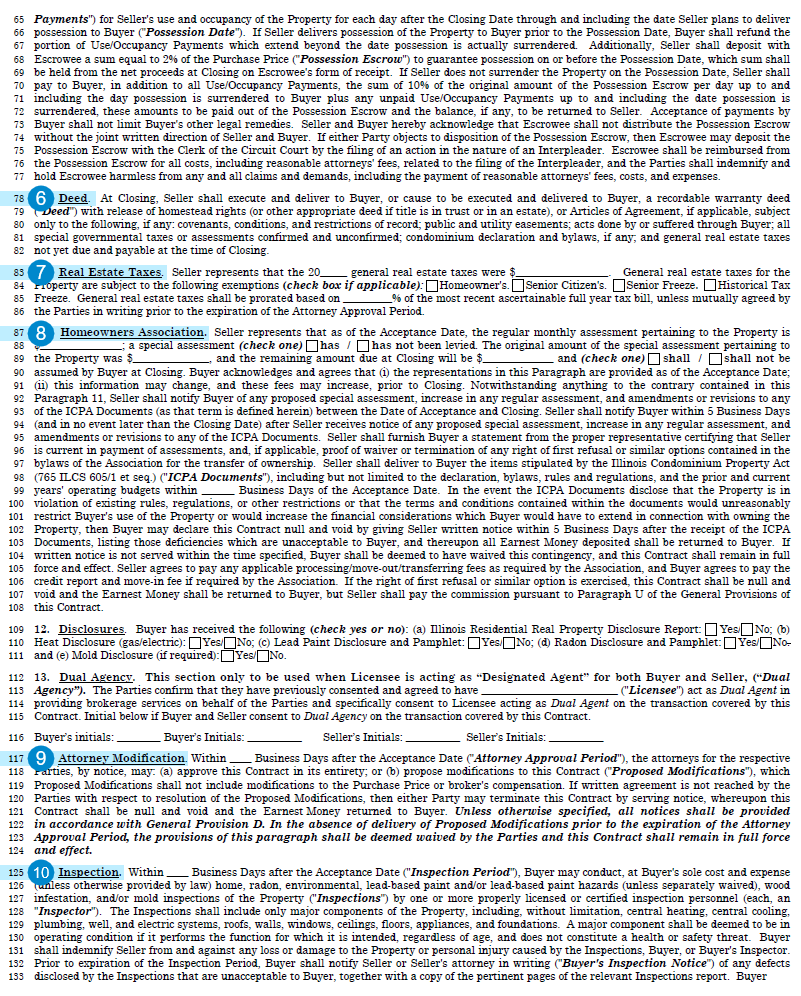

Sales Contract, Page 2 of 4

-

Deed:

A deed is a legal document that transfers real estate ownership from the seller to you. You sign the deed at closing. The title company records the signed deed with the local county recorder to make it official. -

Real Estate Taxes:

Property taxes are levied on real estate by the government. The amount of the property tax is typically based on the property's value and is usually collected annually.

For example, property taxes are typically due in two installments in Cook County, Illinois. The first installment is due on March 1st, and the second is due on August 1st.

When you buy a home, property taxes are prorated as of the closing date, meaning that you and the seller each pay your share of the taxes for the year. The specifics depend on the contract. -

Homeowners Association:

A homeowners association (HOA) represents the owners of homes in a particular neighborhood, condo, or townhome development. HOAs maintain common areas and amenities, enforce covenants and restrictions, and manage the overall appearance and maintenance of the community. If the property is in an HOA, the contract includes the HOA fees you will be responsible for paying after buying the home. -

Attorney Modification:

Attorney modification contingency is a provision included in a real estate sales contract that gives you and your attorney time to change the agreement before it becomes legally binding. The attorney review period typically lasts for a few days to a week. -

Inspection:

A home inspection contingency is a provision included in a real estate sales contract that gives you time to have the property professionally inspected before finalizing the sale. The purpose of the inspection is to identify any potential issues or defects with the property, such as structural problems, electrical or plumbing issues, or pest infestations.

The home inspection contingency typically includes a specific timeframe within which you must complete the inspection. After the inspection, you may choose to proceed with the sale as is, or you can ask the sellers to make repairs or give you a seller credit to cover the costs of repairs.

Sales Contract, Page 3 of 4

-

Offer Date:

The offer date in a real estate sales contract refers to the date you submit an offer to purchase the property to the seller. The offer date is essential for both the buyer and the seller, as it marks the beginning of the negotiation process and the start of the contract period. The date of the offer is also crucial because it can affect the contingencies in the contract, such as the attorney review, inspection, and mortgage. -

Acceptance Date:

The acceptance date in a real estate sales contract refers to the date on which the seller formally accepts your offer to purchase the property. This date signifies the point at which the contract becomes legally binding, and both parties are obligated to follow through with the sale. The acceptance date is crucial because it marks the end of the negotiation period and the start of the contract period. -

Buyer's Agent:

The buyer's agent is the real estate agent representing you in the deal. Your agent is responsible for helping you find a suitable property, negotiating the purchase price and terms on your behalf, and assisting you throughout the process of purchasing the property. -

Buyer's Attorney:

You're not required to have a real estate attorney when buying a home. However, in Chicago, most home buyers use real estate attorneys. It's generally a good idea to have an attorney review the sales contract and other legal documents related to the transaction. An attorney can help you understand your rights and obligations under the contract and advise you on any potential legal issues. -

Buyer's Lender:

The buyer's lender is the mortgage company providing the home loan. Your real estate agent typically includes the lender that pre-approved your mortgage. However, you can change lenders before closing, and you're not required to use the lender listed on the sales contract.

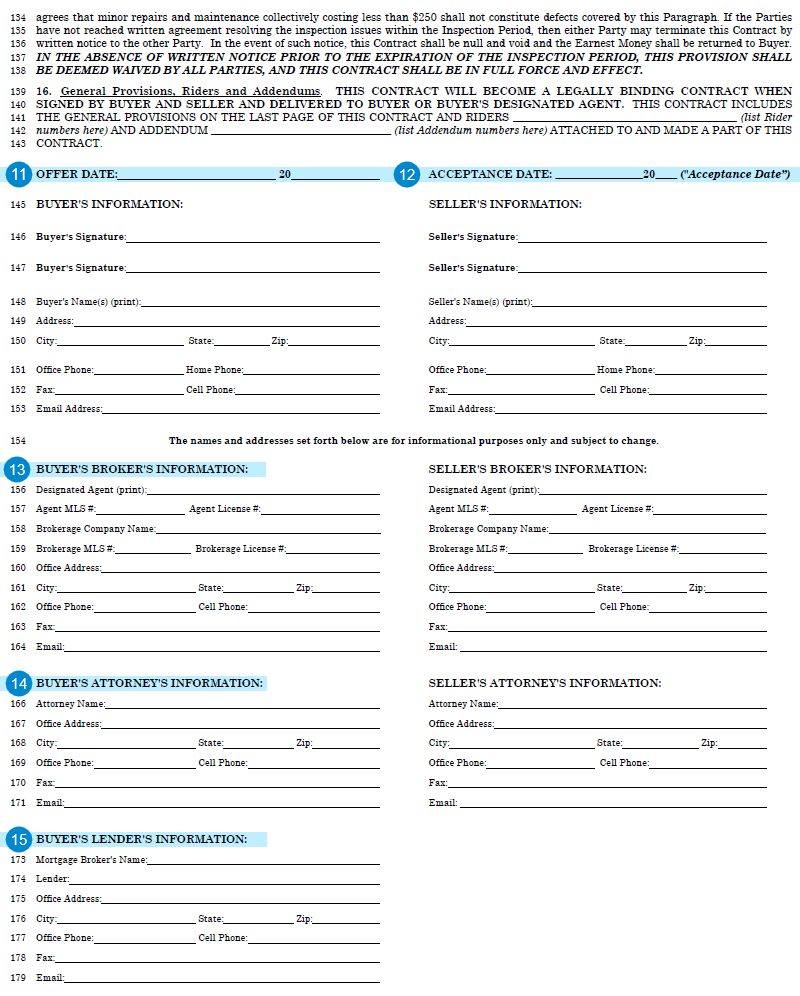

Sales Contract, Page 4 of 4

-

Prorations:

Proration divides certain expenses, such as taxes, utility bills, HOA fees, and rental income, between you and the sellers based on the number of days you own the property during a specific period. Proration ensures that you and the sellers pay your fair share of expenses based on the time they owned the property. The closing agent or attorneys typically settle prorations at closing.

For example, if you buy the house on January 15, you would split the monthly water bill with the sellers. They would pay the first half, and you would pay the second half. Similarly, you divide the real estate taxes based on when you take possession of the property. -

Title:

"Title" refers to the legal ownership of the property. The seller transfers the title to you at closing.

The title company plays a crucial role in your purchase. They ensure the property you buy is free and clear of legal issues or encumbrances, such as outstanding liens or judgments. They also issue title insurance to protect you against any future claims on the property. Typically, the tile company prepares the final Closing Disclosure, disburses funds, and transfers property ownership from the seller to you at closing.

When you buy a home in Illinois, the seller's attorney typically selects the title company you and the seller will use for the transaction. However, you don't have to use the seller's title company. When the fees from the seller's title company are too high, consider using a different title company to handle the purchase side of the deal. -

Disposition of Earnest Money:

Disposition of earnest money is a provision that outlines what happens to your earnest money deposit if the sale doesn't go through. Earnest money is a deposit to show that you're serious about purchasing the property. It's usually held in escrow by a third party, such as a title company or an attorney, until the closing. -

Transfer Tax:

A transfer tax is the city, county, or state's tax on any change in ownership of real estate. The amount and who pays it depends on where you buy, and you might not have to pay any transfer tax. In the City of Chicago, for example, buyers pay $3.75 for every $500 of the purchase price. So, if you buy a place for $500,000, your Chicago Real Estate Transfer Tax would be $3,750.

See how much you'll pay in taxes using our Transfer Tax Calculator.