Interest rates fluctuate. A mortgage rate lock freezes your interest rate for a set time, protecting you if it rises. As a result, you know how much your loan will cost before closing.

What is an interest rate lock?

A rate lock is an agreement between you and a mortgage lender. The lender agrees to give you an interest rate with certain fees for a specific time. In return, you agree to accept the lender's rate and fees and close the loan before the lock expires.

Let's say the lender offers a $400,000 loan at 6.5% with $1,000 in origination fees for 45 days.

By locking, you accept the lender's terms, and the lender agrees to hold the rate at 6% for 45 days.

How long can you lock in an interest rate?

The lock period is the duration of the lock—the number of days from the lock date through the expiration date.

Different lenders offer different lock periods. For example, NewCastle Home Loans offers 30, 45, and 60-day locks.

Your lock period must last until the closing, the day you buy the home, finalize the paperwork, and transfer the money and ownership of the property. The closing date is usually 30 to 45 days from the real estate sales contract acceptance date.

Suppose you agree to close 30 days after the seller accepts your offer. Then, lock the interest rate for at least 30 days so the rate lock expires after the closing date.

More extended lock periods typically cost more. The lender's rate and origination fees for a 60-day lock may be higher than those for a 45-day lock and a 30-day lock.

A lender offering 6.5% with $1,000 in origination fees for a 60-day lock may offer 6.375% with $500 in fees for a 30-day lock.

Do lenders charge a rate lock fee?

Lenders typically do not charge a fee to lock your rate. However, some lenders may ask you to pay a one-time, non-refundable fee when you lock. The fee helps the lender offset their potential loss if you go elsewhere for a lower rate.

Be sure to ask the lender about any associated fees upfront so you can factor them into your decision-making process.

Use a lender that does not charge a rate lock fee. If rates drop before you close, you want the flexibility to negotiate a lower rate or change lenders without losing money.

Avoid locking for 90 days or more. Extended locks usually come with high rates and non-refundable rate lock fees.

NewCastle Home Loans does not charge a rate lock fee, so you can shop rates from multiple lenders without penalty.

When should I lock in my interest rate?

Consider locking in your interest rate soon after you're under contract to buy a property. Under contract means the seller accepted your offer, and you have a signed sales contract.

When you're under contract, you have the details the lender requires to lock the rates, such as the property address, purchase price, loan amount, and closing date.

Locking in your interest rate can be a complicated decision that involves balancing market conditions and the timeline of your home purchase.

Nobody knows if they will go up or down.

How do I lock the mortgage interest rate?

Tell the lender to lock the interest rate. They won't automatically do it for you. To lock in a mortgage interest rate, you typically follow these steps:

- Contact your lender: Once you've found a property and have a sales contract, ask the loan officer for the current rate and origination fees.

- Review terms: Your lender will provide the current interest rates and terms for locking in your rate. Ask for an official Loan Estimate to shop and compare offers from other lenders.

- Request a rate lock: After selecting a rate, tell the loan officer to lock the rate. The lender confirms your lock by sending you a Loan Estimate and a Rate Lock-in Agreement. Because many banks mail the forms via USPS, ask the loan officer to email you confirmation immediately. Review them and contact the loan officer if you have questions.

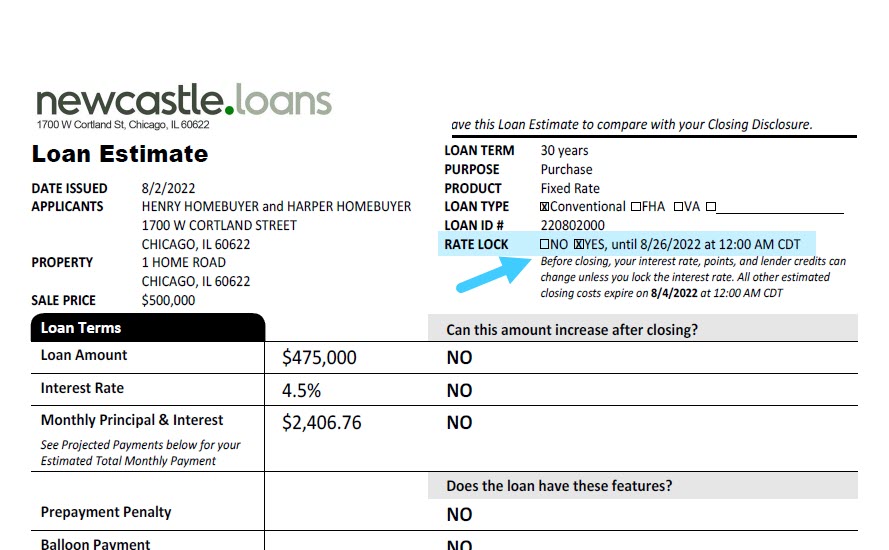

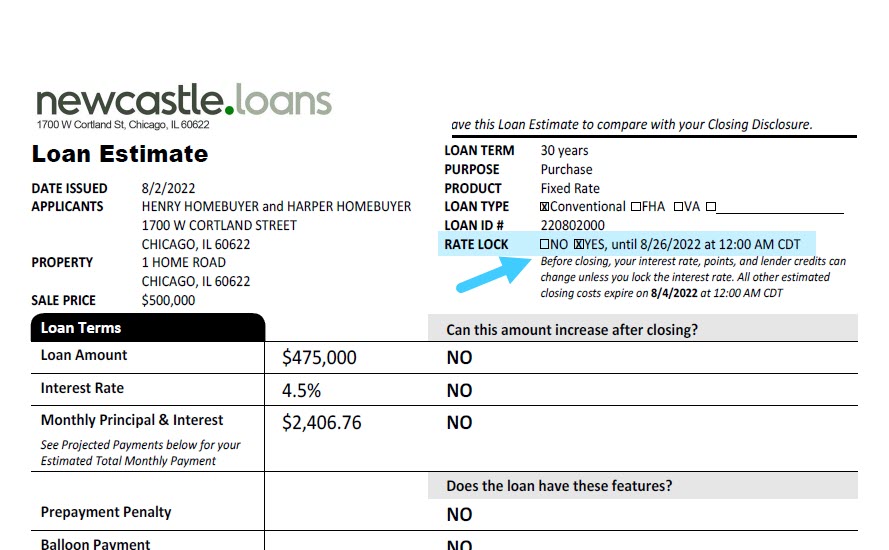

First, review page one of the Loan Estimate to ensure the rate is locked and expires after the closing date.

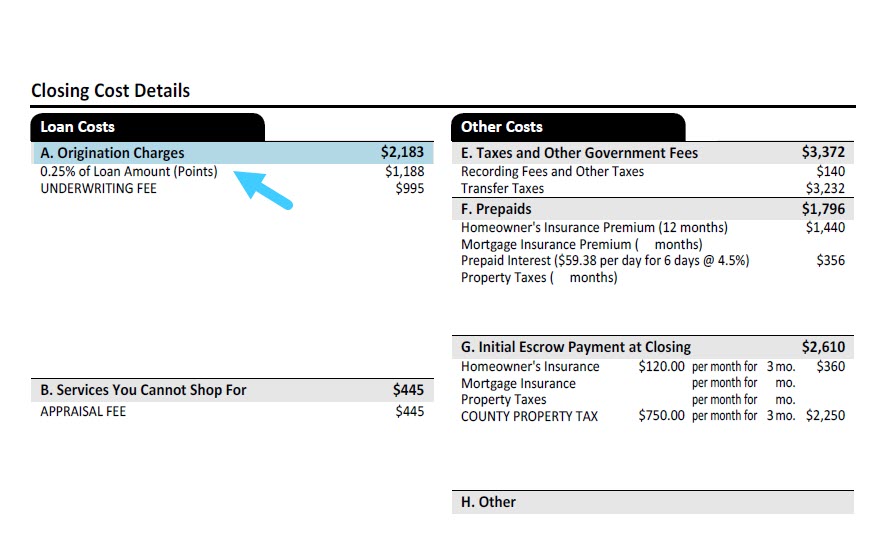

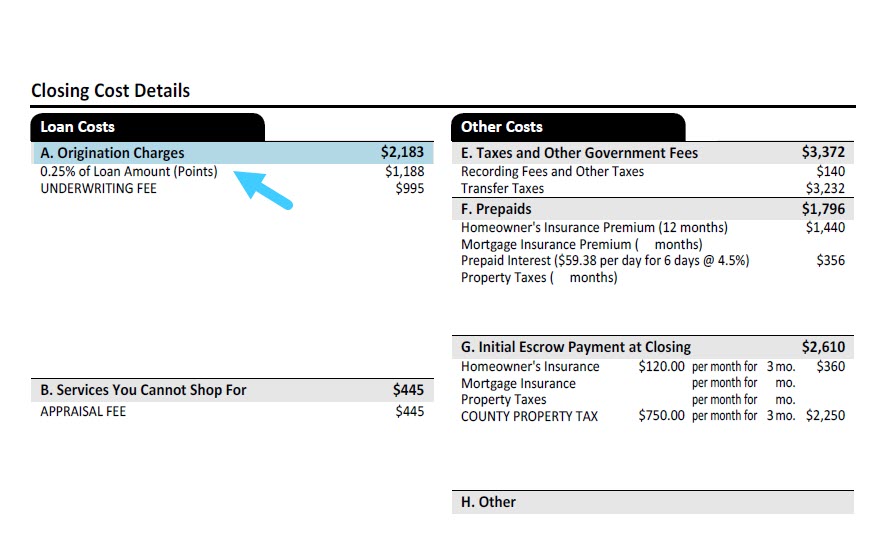

Next, review the Origination Charges in section A, page two, in the Loan Costs column on the left. Origination Charges are fees paid directly to the lender at closing.

Use our free mortgage calculator. It gives you honest rates and closing costs in real-time, so you know how much money you need to buy a home.

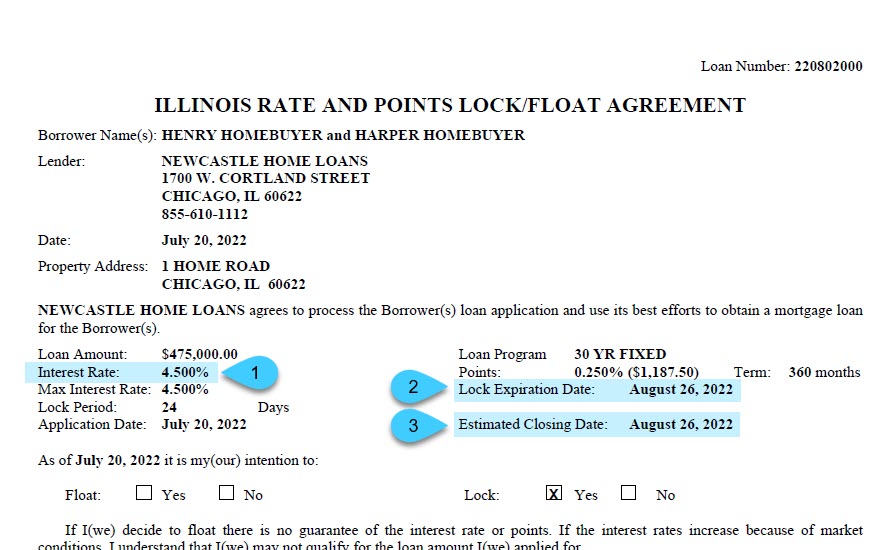

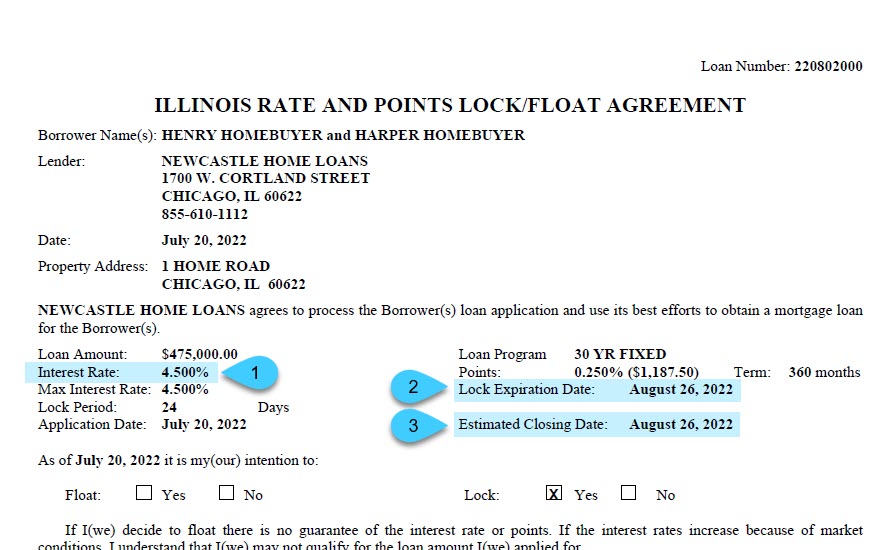

Then, read the Rate Lock-in Agreement.

- Interest Rate

- Lock Expiration Date

- Estimated closing date

At NewCastle, we confirm your lock instantly by email and through the loan dashboard, so you never worry about errors.

What if I lock in a rate, and it goes down?

If you lock your rate and it subsequently decreases, you may have the option to lower your rates through renegotiation or a float-down provision, depending on the terms of your rate lock agreement and your lender's policies.

Your rate lock agreement works two ways. First, you accept the lender's terms. Then, the lender won't change your rate, payment, or fees in exchange.

You feel more secure after locking in because you know what to expect for a monthly mortgage payment. And if rates increase afterward, you feel pretty good about your decision to lock.

But on the other hand, when rates drop after locking, you want a lower rate. We get it. A lower rate is an opportunity to save money over the long term.

Ask the lender's loan officer for a lower rate. They might concede to keep your business. If he says no, decide if switching lenders is worth the savings.

You can view today's rates and fees on our website in real time to see if we can offer you a better deal.

Can I switch lenders after the locking rate?

You may change lenders after locking a rate for any reason. However, it usually happens because the initial lender denies the loan, not of the interest rate and fees.

If you decide to switch, you must reapply with the new lender. So, ensure the new lender has enough time to process, underwrite, and prepare your loan for closing.

Then, decide if going through the loan process again is worthwhile. Start by checking the new lender's rates and fees and determining if they will reuse any services you already paid for, such as the appraisal.

NewCastle Home Loans can have your loan ready to close ten days after you apply. So if you need help closing quickly, please get in touch with us.

Can the interest rate change after locking?

After locking, the lender may still increase your interest rate and fees if you change your application. For example, the following changes could affect your rates.

- The loan type or terms change.

- The down payment or loan amount decreases.

- The appraisal value is higher or lower.

- The lender could not document your income.

- Your credit score is lower.

What happens if my rate lock expires?

If your rate lock expires, you must relock it before closing. When relocking, the lender gives you the current market rate or the rate you locked initially, whichever is higher.

For example, your initial rate of 6% expired, and rates have since increased to 7%, so your new rate after relocking is 7%. On the flip side, if rates decreased to 5%, your new rate after relocking is 6%, the same as your initial rate.

Before the rate lock expires, ask the lender to extend it if you need more time.

How much does a rate lock extension cost?

A rate lock extension is when the lender adds extra days to your rate lock period. Most lenders allow you to extend the rate lock for a fee if you request it before it expires.

Different lenders charge different fees. And typically, the longer you need, the more it will cost.

NewCastle Home Loans charges a fee of 0.30 percent of the loan amount to extend the lock for ten days. For a $100,000 loan, a 10-day extension would cost $300. If you need more time, you can request another. We offer three for a total of 60 days

Who pays for a rate lock extension?

As you can imagine, lock extension costs can add up. And it's not fair for you to pay when the delay is someone else's fault. So, of course, NewCastle covers the cost if we're to blame. However, we charge you the extension fees when the seller delays the closing. Typically, buyers ask sellers to pay the fees through a seller credit.

Reliable information sources :